2023-07-03

1. It has real adoption.

Polygon has 3 different blockchains.

#1 Polygon formerly known as the Matic Network.

Its own layer 1 blockchain formerly called the Matic Network. It has MATIC as a

native token. Matic Network was launched in 2017. Developers can build dApps

and NFTs using MATIC as a means of payment. It is EVM compatible. There are

many DeFi platforms and NFTs on Polygon blockchain such as AAVE and Quickswap.

Its time to finality is 2-3 seconds and

can handle 7,000 TPS. Polygon currently has $972 million total value locked. Many

well-known DeFi platforms such as Aave, Curve, Uniswap, and Compound support

Polygon.

#2 Polygon sidechain also knowns as

Polygon PoS.

Polygon sidechain also known as Polygon PoS. It helps Ethereum solve

scalability problem. Ethereum transactions can process on Polygon sidechain and

bridge back to Ethereum mainnet which lower transaction costs.

Validators need to stake MATIC in order to operate the sidechain.

Those validators earn fees in the form of MATIC.

#3 Polygon zkEVM

It is EVM compatible and developers can

bring dApps from Ethereum to Polygon zkEVM. Users can bridge ETH from Polygon

zkEVM to Ethereum mainnet. It is similar to Arbitrum, Optimism, and zkSync Era.

As of July 3, 2023. Polygon zkEVM has

$28.2 million total value locked. Quickswap, PancakeSwap, Balancer, and

SushiSwap are now support Polygon zkEVM.

Details about Polygon blockchain.

-Time to finality: 2-3 seconds.

-Transaction fees: $0.00022.

-Polygon transactions

per second: 7,000 TPS .

-Max supply: 10,000,000,000 MATIC

-Fully diluted

market cap: $6.86 billion.

As of July 3,

2023.

2. MATIC has better use cases than ARB

and OP.

-MATIC uses for paying transaction fees

in layer 1 network and sidechain.

-MATIC uses for staking to become

validators for both layer 1 and sidechain. Whereas, ARB and OP are governance

tokens.

-MATIC price is cheaper than ARB and

almost 2 times more expensive than OP. MATIC is the best choice if you want to

have exposure in layer 2 tokens.

-MATIC holders can stake the tokens.

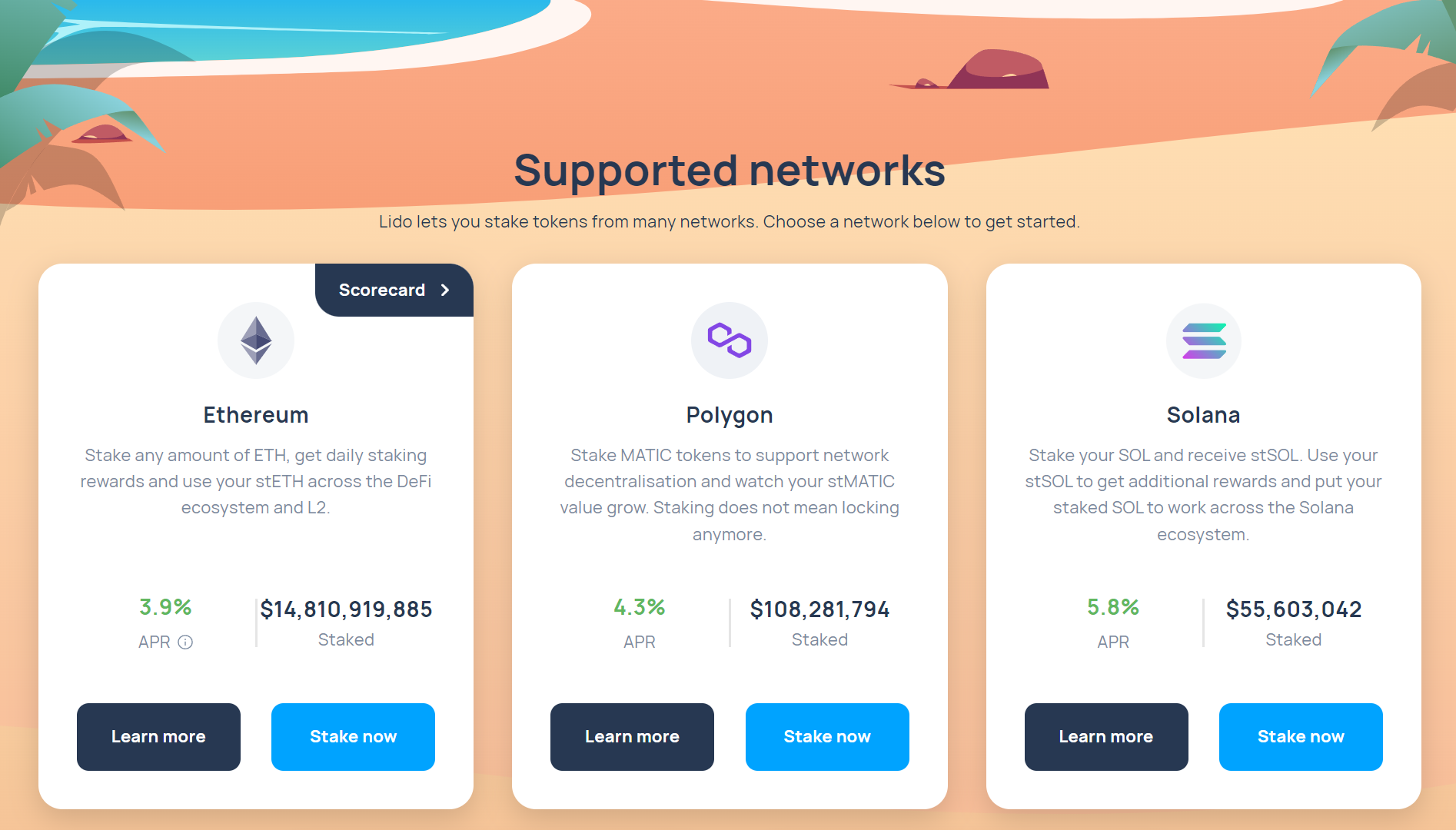

MATIC staking has 4.3% APY.

3. Polygon has strong ecosystem

Ecosystem

DeFi

- Polygon currently has $839 million

total value locked.

- Aave

-Quickswap

- LidoDAO

- Maker

- Compound

NFTs

-OpenSea NFT Marketplace

-MagicEden NFT Marketplace

-y00ts

-Trump Digital Trading Cards

Gaming

-The Sandbox

-Decentraland

Payment

-MetaMask

Competitors

Investors have other choices that have similar

upside when compare to Polygon. Polygon layer 1 process transactions a little

slower than AVAX and Solana.

1. Avalanche

Fully diluted market cap: $9.56 billion.

Total value locked: $704 million.

Price

prediction: 5X return in the next bull market.

2. Optimism

Fully diluted market cap: $5.82 billion.

Total value locked: $842 million.

Price prediction: 3X return in the next

bull market.

3. Solana

Fully diluted market cap: $10.70 billion

Total value locked: $271 million.

Price prediction: 5X return in the next

bull market.

4. Arbitrum

Fully diluted market cap: $11.69 billion.

Total value locked: $2.18 billion.

ARB is overvalued. It has higher

valuation than MATIC.

Price prediction: 2X return in the next

bull market.

Polygon Price Prediction

If you want to invest in layer 2

tokens. MATIC is the best choice. MATIC uses for paying transactions fees on

the sidechain and uses for staking. MATIC has a better use case when compare to

ARB or OP tokens. MATIC can store value much better than ARB and OP.

Due to its technology and adoption

MATIC will perform well in the next bull market. We can expect about 7X return

from MATIC in the next bull market.

Polygon has the tendency not to win in

layer 1 competition as it facing fierce competition from other layer 1 platforms

such as Solana, and Avalanche.

On the other hand, Polygon has the

tendency to win in layer 2 space. Polygon only has 3 major competitors for

layer 2 including Arbitrum, Optimism, and zkSync Era. The price of MATIC should

be on par with Solana. Expected valuation in the next bull market is $50

billion.