2023-07-20

The future of blockchain is interoperability.

Axelar aims to create cross-chain

communication and enable connection between blockchains. It enables dApps to

communicate cross-chain. Axelar network can be used for DeFi swap and lending

using collateral from multiple chains. It also can be used to transfer tokens

cross-chain.

Axelar supports Ethereum, Avalanche, Polygon, BNB,

Fantom, Moonbeam, Osmosis, Kujira, Cosmos, Juno, and Celo.

Axelar plans to support Sui, Aptos, and

Optimism in the future.

Axelar Total Value Locked.

1. Osmosis $43.65 million.

2. Kava $15.35 million.

3. Celo $5.93 million.

4. Fantom $5.34 million.

5. Terra 2 $4.75 million.

6. Kujira $4.43 million.

7. Juno $2.87 million.

8. BNB Chain $2.64 million.

9. Umee $2.37 million.

10. Arbitrum $1.6 million.

Total TVL $93.52 million.

As of July 20, 2023.

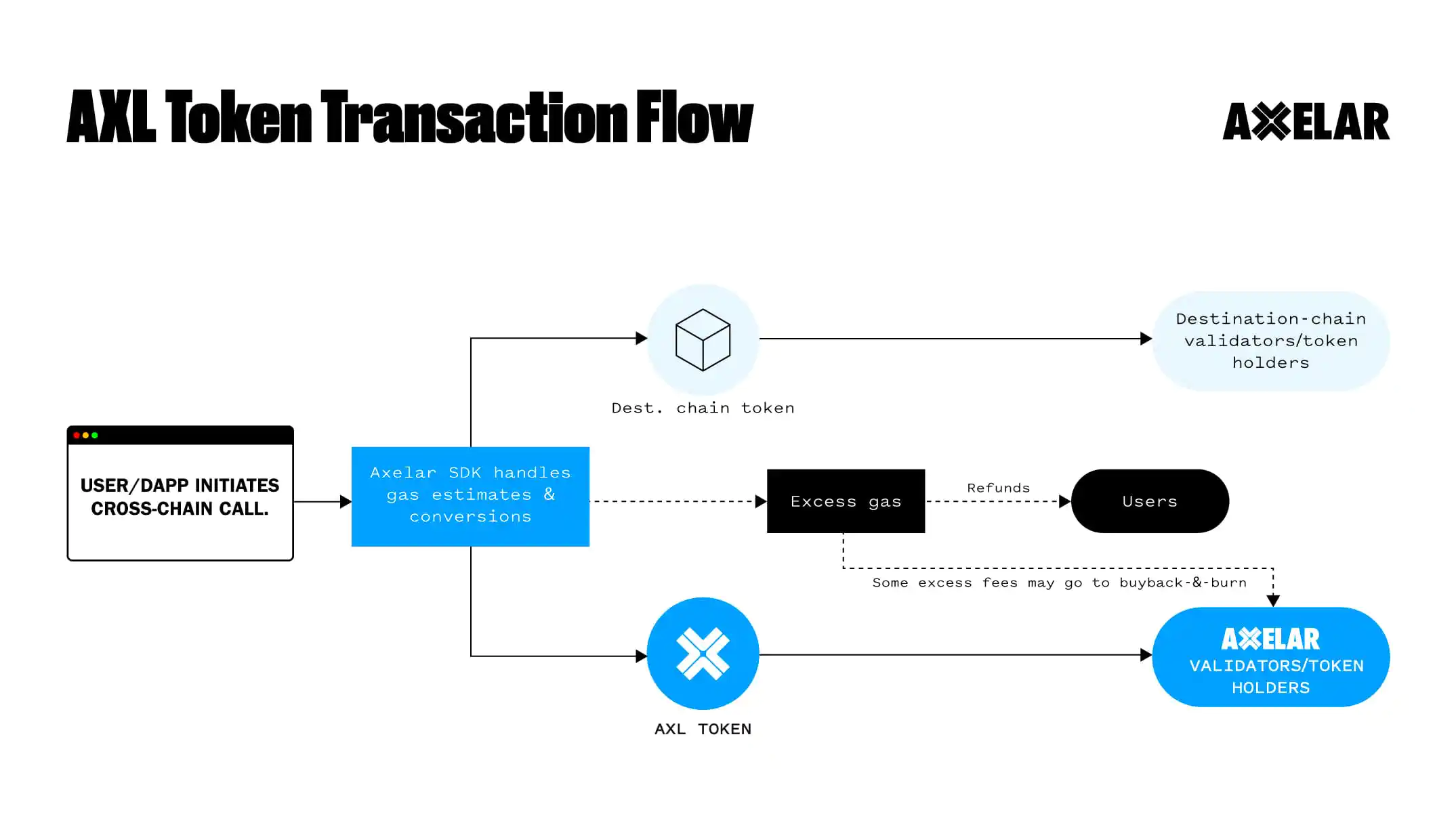

AXL Token

AXL tokens use for staking to provide

security in the Axelar blockchain, and also use for transaction fees and

governance. Axelar has a total supply of 1,077,290,366 AXL. AXL tokens

currently are inflationary.

Axelar conducted 3 rounds of token sale.

1. Seed round, $0.028 per token in

September 2022.

2. Series A round, $0.213 per token in

July 2021.

3. Series B round, $1 per token in January

2022.

You can see how Axelar works at

satellite.money, it is a cross-chain protocol that powered by Axelar.

Price Prediction

AXL currently trade at $0.356 per

token. Axelar has a fully diluted of $380 million.

Minimum expected valuation of Axelar is

1 billion fully diluted market cap. This is 163% return from the current price.

Maximum expected valuation of Axelar is

$2 billion fully diluted market cap. Or 426% return.

Overall, it is okay for Axelar to have

a 163% return. The project is still small and it is still at an early stage.