2024-08-08

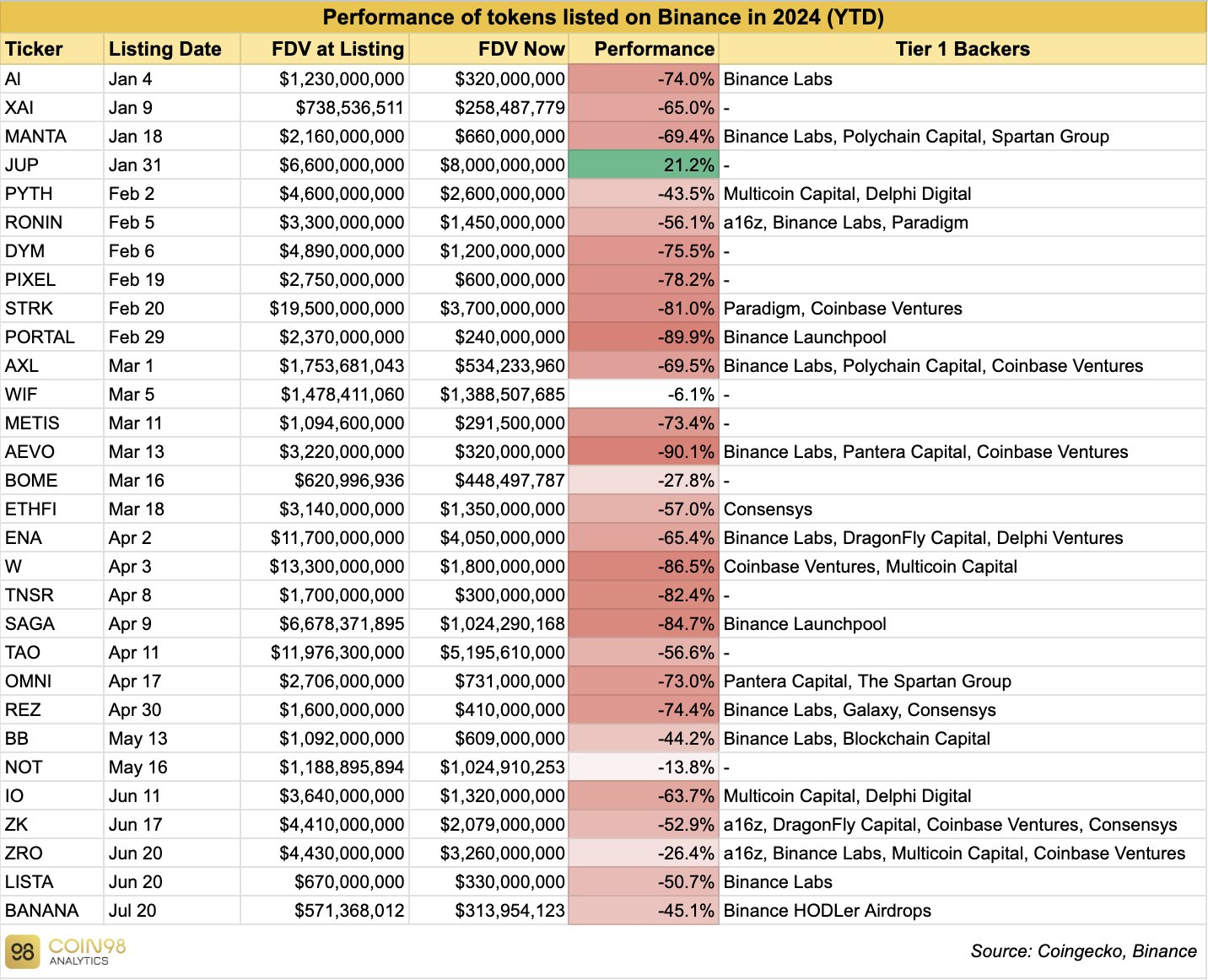

The report from Coin98 highlights a downturn in the performance of cryptocurrencies listed by Binance in 2024.

Of the 30 tokens listed by Binance in

2024, 29 tokens have seen a decrease in

value. This trend reflects the challenges many new tokens face after their

initial listing.

The only exception is Jupiter (JUP),

interestingly, Jupiter’s token (JUP) is the only one among the 30 newly listed

tokens that has gained, showing an increase of 21.2%. This stands out as an

exception in a market where most tokens are struggling.

The situation also brings attention to

the issues with airdrop models, which have been a common strategy for new

tokens to gain initial traction and distribution among potential users.

A large number of tokens airdrop in

2024 is making cryptocurrency market oversupply but the new users coming into

the crypto market to absorb these new tokens is lower than expected.

Jupiter is the only exception

Jup.ag is a decentralized finance (DeFi) platform that acts as an aggregator for the Solana blockchain. It provides users with a way to find the best prices for token swaps by routing their trades through various decentralized exchanges (DEXs) to optimize for the lowest slippage and best rates.

Jup.ag supports a wide range of tokens

available on the Solana network, making it easier for users to trade tokens

efficiently and effectively. The platform aims to enhance liquidity and improve

trading experiences by leveraging multiple liquidity sources within the Solana

ecosystem. Jupiter vs Uniswap?

Jupiter’s TVL

$621 million.

JUP token valuation

Market Cap: $1.141 billion

Fully Diluted Market Cap: $8.459 billion

Ranking: 56th largest crypto by market cap

Jupiter vs. Uniswap differences

Jupiter (Jup.ag) and Uniswap are both

decentralized exchanges (DEXs) that facilitate the trading of cryptocurrencies,

but they operate on different blockchains and have some distinct features.

Blockchain

Jupiter operates on the Solana blockchain, known for its high speed and low transaction costs.

Uniswap operates on the

Ethereum blockchain, which is widely used but can suffer from high gas fees and

slower transaction times. Uniswap is also available on other blockchains as

well.

Functionality

Jupiter acts as an

aggregator, finding the best prices across various DEXs on the Solana network.

It routes trades through the most efficient paths to optimize for the best

rates and lowest slippage.

Uniswap is a standalone

DEX that provides liquidity pools for trading directly on the Ethereum network.

It uses an automated market maker (AMM) model, where users can trade directly

against liquidity pools.

Fees

Jupiter benefits from Solana’s

low transaction fees, making it cost-effective for traders.

Uniswap’s transaction fees can be high for

Ethereum blockchain, which can vary significantly depending on network

congestion. But on other blockchain networks are cheap.

Liquidity

Jupiter aggregates

liquidity from multiple DEXs on Solana, potentially offering deeper liquidity

and better trade execution.

Uniswap’s liquidity is provided by users directly to Uniswap’s pools. Liquidity can be extensive but might be fragmented across different pairs.

User Experience

Jupiter aims at

providing an optimized trading experience by aggregating liquidity and finding

the best trade routes on Solana. It can be more complex due to the aggregation

of multiple DEXs.

Uniswap is simple and user-friendly

interface, making it easy for users to swap tokens directly from their wallets.

However, users might face higher costs due to gas fees.