2025-03-06

Bitwise Asset Management, a leading

cryptocurrency asset management firm based in San Francisco, California, has

applied to create an Aptos ETF

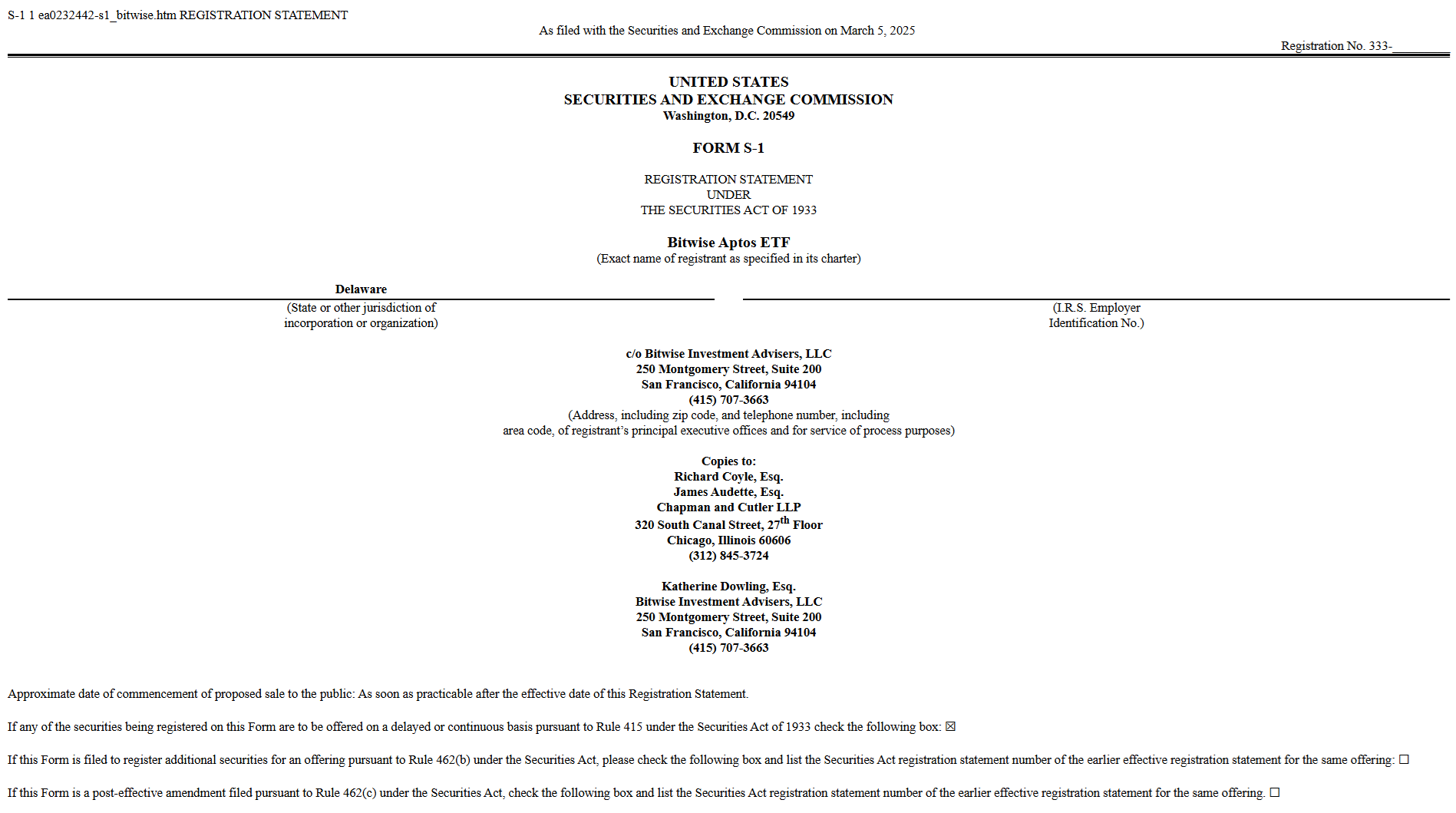

The company filed an S-1 registration

with the U.S. Securities and Exchange Commission (SEC) for a Bitwise Aptos ETF

(exchange-traded fund) on March 5, 2025.

Last week, Bitwise took its first step

by registered a Bitwise Aptos ETF entity in Delaware.

Many companies are looking to create

investment funds based on alternative cryptocurrencies (altcoins). Bitwise has

also applied for Dogecoin and XRP ETFs.

Aptos is a Layer-1 blockchain developed

by Aptos Labs. Its goal is to provide a fast, scalable, and user-friendly

platform for decentralized applications and smart contracts.

Its token, APT, is the 36th largest

cryptocurrency in the world, with a market value of about $3.8 billion.

Previously, in November, Bitwise

launched an Aptos Staking ETP on six Swiss exchanges.

A competing firm, 21Shares, launched a

similar Aptos Staking ETP in Euronext Amsterdam and Paris.

Crypto management firms currently hope

that more cryptocurrency-based funds could be approved as the U.S. government easing

regulations for such products.

sec.gov/Archives/edgar/data/2059135/000121390025020626/ea0232442-s1_bitwise.htm