2025-03-28

BlackRock is deepening its presence in

blockchain finance by expanding its tokenized money market fund, BUIDL, to the Solana

blockchain.

Launched in March 2024, BUIDL offers

institutional investors on-chain access to U.S. dollar yields with daily

dividends and near-instant transfers.

It now operates across seven

blockchains, including Ethereum, Avalanche, and Polygon.

The expansion, announced by tech

partner Securitize, aims to leverage Solana’s low fees and fast settlement

speeds, giving investors more flexibility.

The expansion comes amid rising demand

for real-world asset (RWA) tokenization, where traditional assets like Treasury

bonds are brought on-chain. BUIDL holds $1.7 billion in assets—primarily

Treasuries and cash—and is expected to cross $2 billion in early April.

BlackRock’s push reflects a trend in

traditional finance embracing blockchain.

BUIDL outpaces competitors like Franklin

Templeton’s on-chain fund and Hashnote’s yield coin, capturing over $235

million in inflows in the past 30 days alone, per RWA.xyz.

Meanwhile, BlackRock also launched a Bitcoin

ETP in Europe, expanding its global crypto footprint.

Its U.S. Bitcoin ETF, iShares Bitcoin

Trust, now holds over $50 billion in assets, representing around 2.7% of all

Bitcoin.

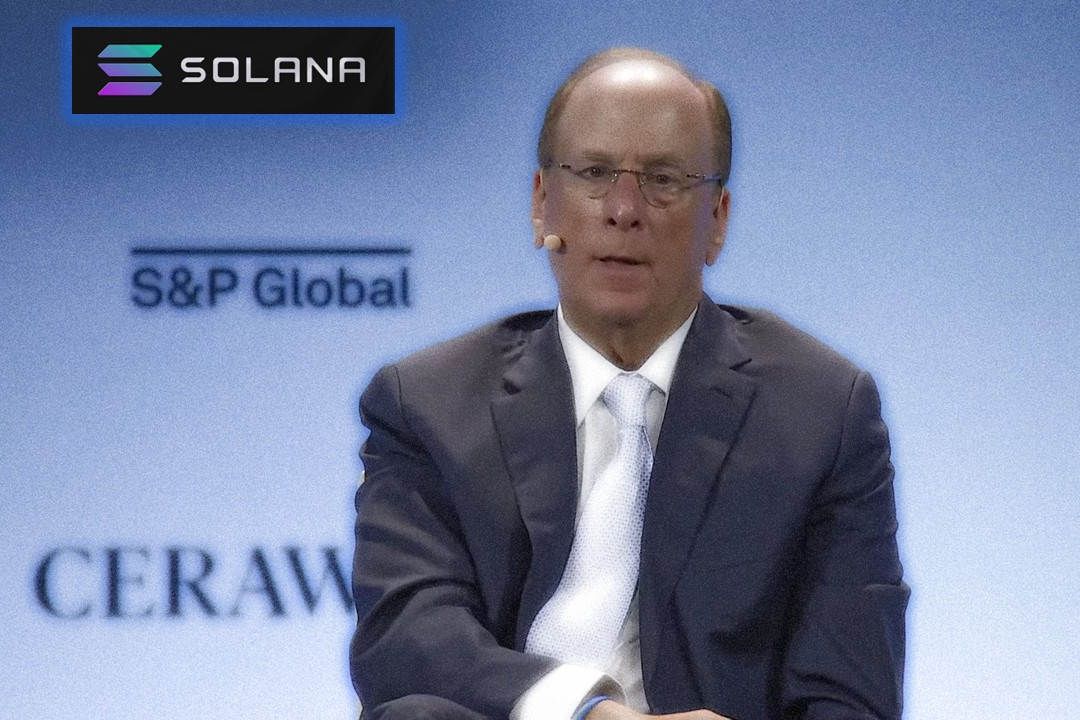

CEO Larry Fink calls tokenization the

next big step after ETFs, saying: “Step two is going to be the tokenization of

every financial asset.”

BlackRock's BUIDL, formally known as

the BlackRock USD Institutional Digital Liquidity Fund, is the

company's first tokenized fund, launched in March 2024.

The fund is the pioneer in integrating

traditional finance with blockchain technology by using various blockchain networks

to tokenize shares in the fund.

The fund uses tokens to represent

shares. Invests in low-risk assets such as cash, U.S. Treasury bills,

short-term debt securities, and repurchase agreements. Assets are managed by

BlackRock Financial Management, with BNY Mellon acting as custodian.