2024-03-20

On Mar 14, 2024, BlackRock has filed

FORM D to the United States Securities and Exchange Commission (SEC) to create a

fund called “BlackRock USD Institutional Digital Liquidity Fund Ltd.”

The fund operates in the British Virgin

Islands. BlackRock partners with Securitize, a tokenization firm, to create

real-world assets tokenization fund.

The fund aims to tokenize asset

classes. Tokenized assets will be on Ethereum blockchain.

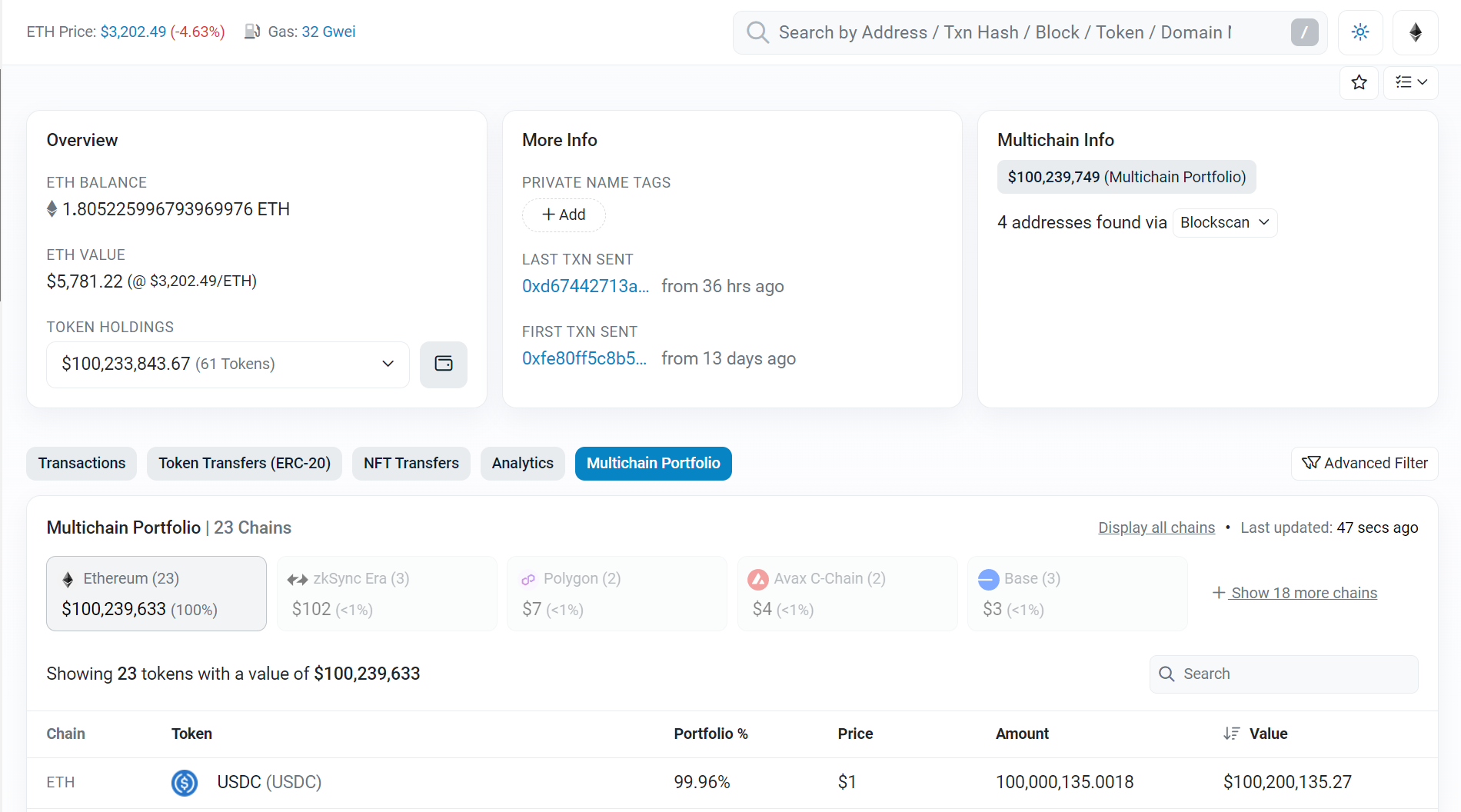

On March 5, BlackRock has created one

token on Ethereum. The token is called BUILD (BlackRock USD Institutional

Digital Liquidity Fund). It has a total supply of 100 tokens.

BlackRock has deposited a capital of

$100 million in USDC on Ethereum to start the fund.

Investors need a minimum of $100,000 in

order to invest in this fund.

BlackRock is one of institutional

investors that is pioneer in cryptocurrency investing. BlackRock’s IBIT spot

bitcoin ETF has been listed for trading on Nasdaq stock exchange.