2024-04-24

BlackRock ’s ICS US Treasury money

market fund (MMF) gets tokenized on Hedera.

BlackRock in partnership with Archax and HBAR Foundation, bring

real world asset on-chain by tokenizing BlackRock ’s ICS US Treasury money

market fund on Hedera hashgraph.

Archax is digital

securities exchange regulated by the FCA based in London.

HBAR Foundation is the developer and

the governing body of Hedera.

Hedera is a decentralized, open-source,

proof-of-stake public ledger that is designed to support a wide range of

applications.

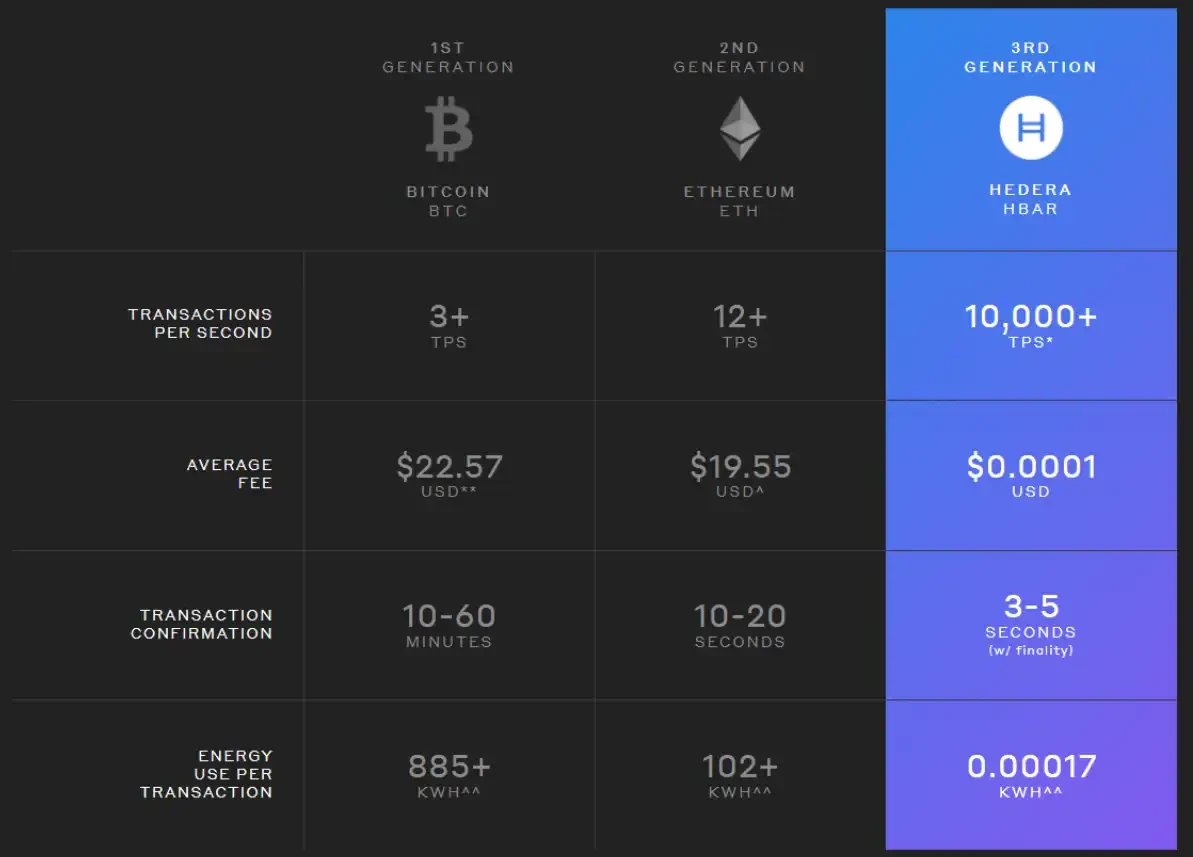

It utilizes the hashgraph consensus algorithm, which is known for its high throughput, low fees, and quick transaction finality.

Hedera’s time to finality is between 3

and 5 seconds. Hedera can process 10,000 transactions per second.

This makes it an attractive platform for various use cases, including decentralized finance (DeFi), non-fungible tokens (NFTs), and sustainability initiatives.

Hedera's network is governed by a

council of diverse organizations, which includes enterprises, web3 projects,

and universities, ensuring a decentralized governance model.

The platform's native cryptocurrency,

HBAR, is used for network services, protection, and treasury management, and is

noted for its energy efficiency compared to traditional blockchains.

Hedera's developers and community can

participate through Hedera Improvement Proposals (HIPs), allowing for

continuous evolution and improvement of the network.