2025-02-25

Cryptocurrency exchange Bybit has fully

replenished the $1.4 billion worth of Ether (ETH) stolen in a major hack

allegedly perpetrated by the North Korea-backed Lazarus Group, CEO Ben Zhou

announced on February 24.

The move follows substantial purchases

of Ether, bringing client assets back to a 1:1 reserve ratio.

Zhou assured users that Bybit will soon

release a new audited proof-of-reserve report using a Merkle tree structure to

confirm the restoration of funds.

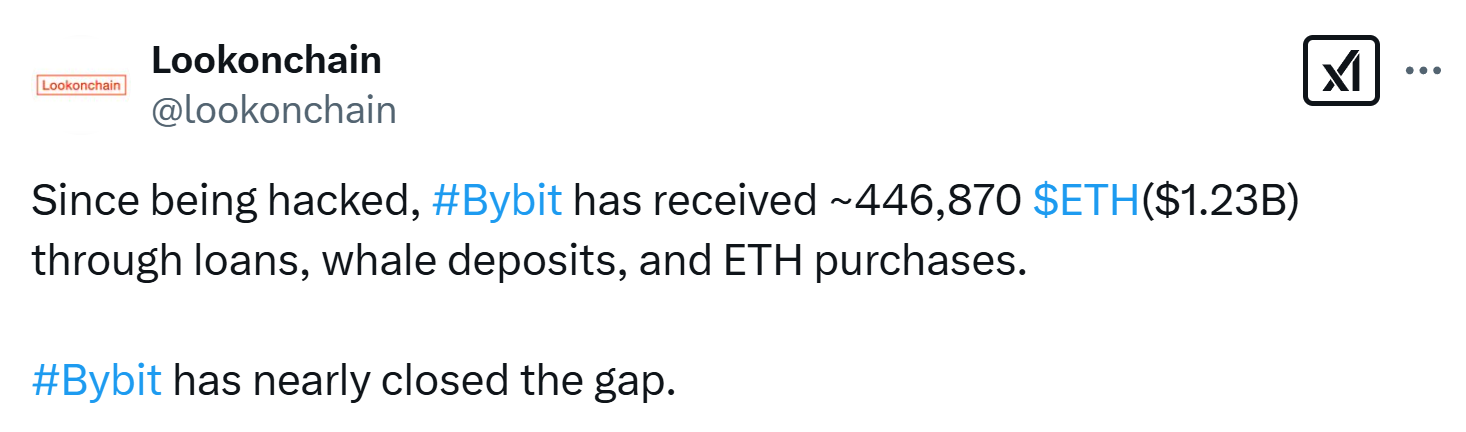

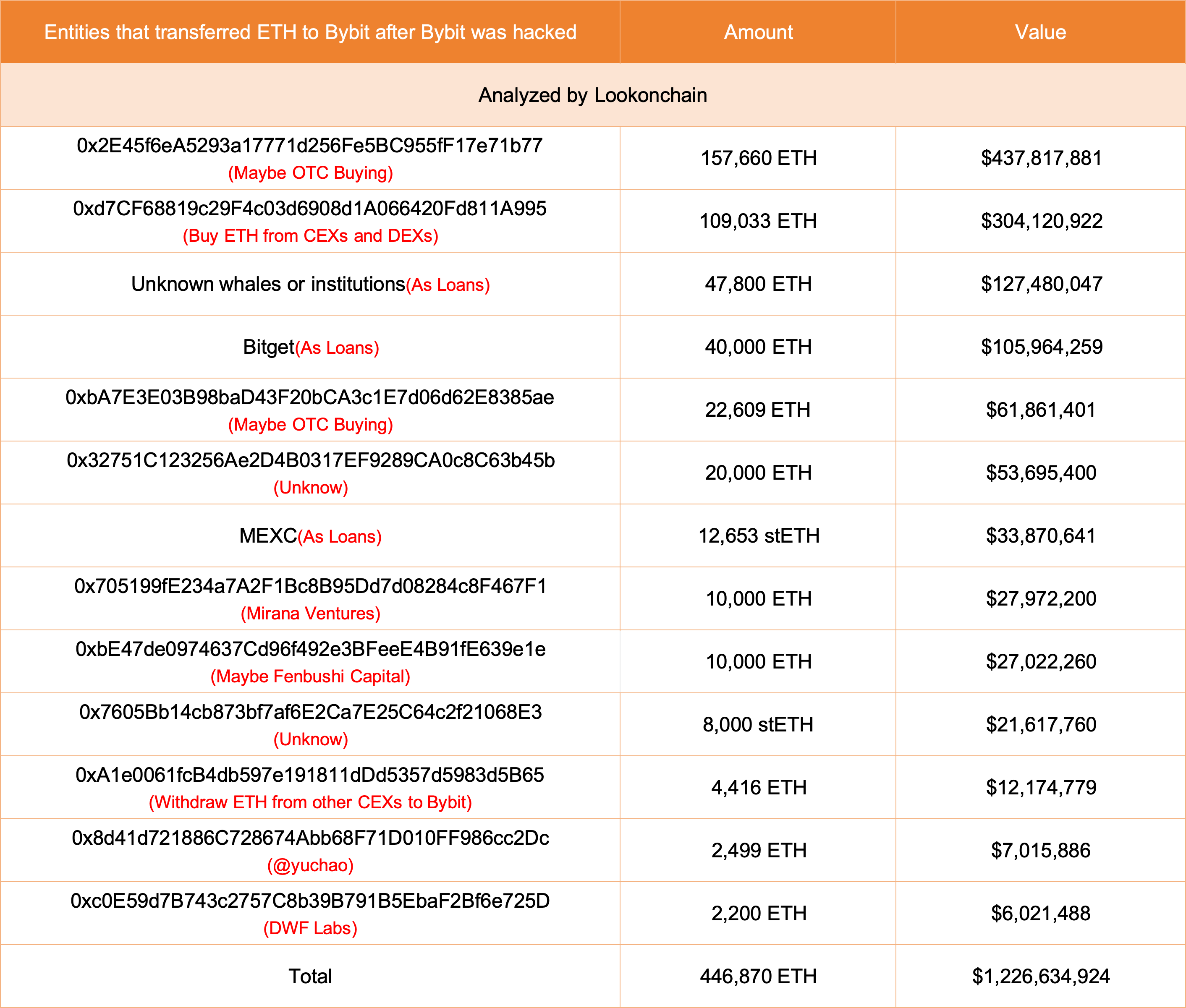

This announcement comes after

blockchain analytics firm Lookonchain reported that Bybit had received 446,870

ETH—worth about $1.23 billion—through loans, whale deposits, and market

purchases. These transactions accounted for nearly 88% of the stolen assets.

Massive ETH Purchases to Close the Gap

According to Lookonchain data, a wallet

address linked to Bybit (“0x2E45...1b77”) purchased 157,660 ETH, valued at

$437.8 million, from major crypto investment firms Galaxy Digital, FalconX, and

Wintermute through over-the-counter (OTC) transactions.

An additional $304 million in Ether was

acquired using another Bybit-associated wallet (“0xd7CF...A995”) via

centralized and decentralized exchanges, as per Arkham Intelligence data. This

address reportedly interacted with Binance and MEXC hot wallets.

Largest Crypto Hack in History

The February 21 breach, which valued at

$1.4 billion in stolen funds, has been deemed the largest in crypto history,

accounting for over 60% of all digital assets stolen in 2024.

The attack prompted Bybit’s customers

to withdraw over $5.3 billion in assets on February 22, highlighting concerns

over security and transparency.

Despite the substantial amount of outflows,

Bybit’s proof-of-reserve auditor, Hacken, confirmed that the platform’s

reserves still exceed its liabilities, ensuring that user funds remain fully

backed.

Data from DeFiLlama indicates that

Bybit’s total assets currently amount to $10.9 billion.

Bybit’s swift action to restore its

reserves indicates that the exchange has a commitment to maintaining user

confidence despite facing unprecedented challenges.