2024-10-09

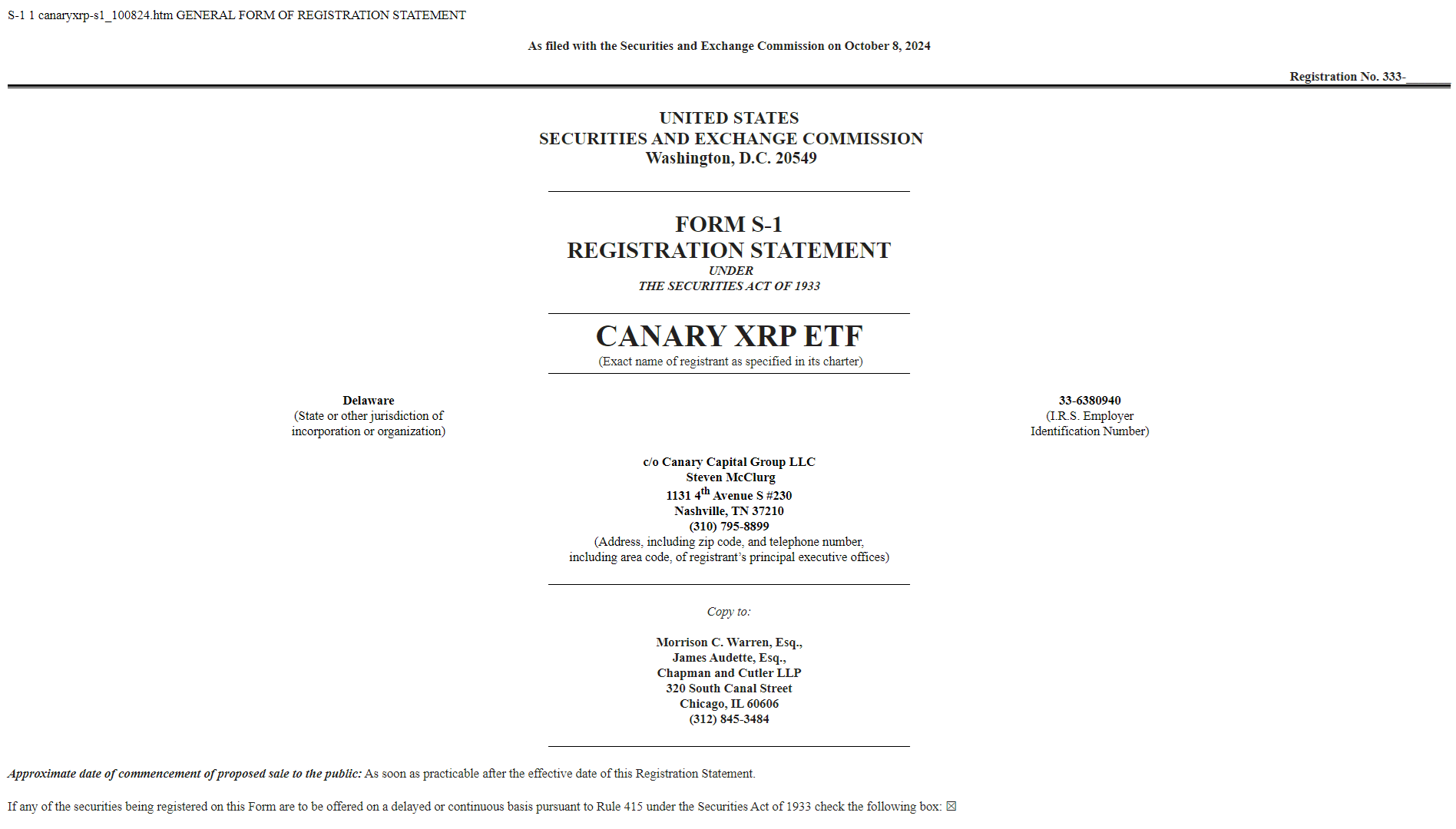

Canary Capital has filed S-1

registration for a spot XRP ETF with the U.S. Securities and Exchange

Commission (SEC). This ETF aims to provide investors with direct exposure to

XRP without the need to buy, hold, or manage the token directly. The fund will

track XRP's value using the CME CF Ripple index, and it will use a mix of cold

and hot wallets for XRP management.

sec.gov/Archives/edgar/data/2039505/000199937124013130/canaryxrp-s1_100824.htm

Canary Capital Group LLC is a

U.S.-based investment firm focused on digital assets, particularly

cryptocurrencies. Founded by Steven McClurg, a prominent figure in digital

asset investments, Canary Capital provides innovative investment solutions for

accredited investors. Its flagship offering is the Canary HBAR Trust, which

gives investors exposure to HBAR, the native cryptocurrency of the Hedera

network—a scalable, enterprise-grade blockchain.

Canary Capital has made headlines with

its filing for a spot XRP exchange-traded fund (ETF) with the United States

Securities and Exchange Commission (SEC) on October 8, 2024.

This move signifies a potential

expansion of cryptocurrency-based financial products within traditional

markets.

The proposed ETF aims to provide

investors with exposure to XRP, the digital asset native to the XRP Ledger,

without the need for direct purchase or management of the cryptocurrency.

Canary Capital's initiative follows

similar effort by Bitwise that filed its S-1 registration on October 2, filing

of XRP ETFs reflect a growing interest in integrating digital assets into

conventional investment portfolios.

The ETF would track the value of XRP

using the CME CF Ripple – Dollar Reference Rate, allowing shares to be traded

on traditional exchanges.

This development comes amidst ongoing

legal proceedings between Ripple Labs and the SEC.

SEC vs. Ripple case raises concern for

XRP ETFs.

The case SEC vs. Ripple is

a major legal battle between the U.S. Securities and Exchange Commission (SEC)

and Ripple Labs, focusing on whether the cryptocurrency XRP should be

classified as a security under U.S. law.

Here is a detailed overview:

Background

Ripple Labs is the company behind XRP,

a cryptocurrency designed for fast cross-border payments.

The SEC filed a lawsuit against Ripple

Labs, its CEO Brad Garlinghouse, and co-founder Chris Larsen in December 2020.

The SEC alleges that Ripple raised $1.3

billion through the sale of XRP in an unregistered securities offering.

SEC’s Arguments

Unregistered Security Offering

The SEC claims that XRP should be

treated as a security, similar to stocks or bonds. Under this classification,

Ripple would have been required to register their sales with the SEC.

Investor Expectations

The SEC argued that Ripple's actions

led investors to believe they could profit from the efforts of Ripple Labs,

aligning XRP with the Howey Test. The Howey Test is used to determine if an

asset qualifies as an investment contract (security), requiring it to meet four

criteria: an investment of money, in a common enterprise, with an expectation

of profits, primarily from the efforts of others.

Centralized Control

The SEC emphasized that Ripple's

management had significant control over XRP's distribution and the network,

making it less decentralized compared to other cryptocurrencies like Bitcoin or

Ethereum.

Ripple's Defense

XRP as a Currency

Ripple argues that XRP is a digital

currency, similar to Bitcoin and Ethereum, which the SEC does not classify as

securities. Ripple maintains that XRP has utility as a bridge currency in

international payments, rather than serving as an investment vehicle.

Lack of Fair Notice

Ripple has argued that it did not

receive "fair notice" from the SEC that its conduct was in violation

of securities law. Ripple claims that for years, the SEC did not clearly define

XRP as a security, leading to confusion in the market.

Decentralization

Ripple also claims that XRP is

sufficiently decentralized, making it distinct from a traditional security.

They argue that many other entities and users use XRP independently, without

direction from Ripple Labs.

Partial Victory for Ripple

In July 2023, a U.S. District Judge

ruled that programmatic sales of XRP (those made on public exchanges) did not

constitute sales of securities, while institutional sales directly to investors

did.

This was seen as a partial win for

Ripple, with XRP classified as not a security when sold to the general public.

This led to a surge in XRP's value and several exchanges relisting XRP.

Current Status and Implications

Unsettled Issues

While Ripple won on some counts, the

SEC's arguments regarding institutional sales and direct offerings mean that

Ripple still has legal challenges. The mixed ruling also left ambiguities

around what constitutes a security in the crypto space.

The partial victory in July 2023 led to

many cryptocurrency exchanges relisting XRP, which they had previously delisted

after the SEC filed its lawsuit.

Affecting broader regulations; the

mixed ruling has generated significant discussion about the need for new

legislation to clarify how digital assets should be classified and regulated,

as the current framework of securities law doesn't align well with decentralized

technologies.

For the lastest update; on August 7,

2024, a federal judge ordered Ripple Labs to pay a little over $125

million civil penalty in its ongoing legal battle with the regulator. The SEC

initially sought a nearly $2 billion penalty, while Ripple wants the fine to be

capped at $10 million.

The outcome of these proceedings could

have significant implications for the approval and future operation of

XRP-related financial products.