2024-12-14

BiT Global is a regulated digital asset

custodian that has been serving clients globally since 2020. The company is

registered as a Trust and Company Service Provider (TCSP) in Hong Kong,

operating under license in Hong Kong.

In August 2024, BiT Global entered into

a joint venture with BitGo, a leading digital asset infrastructure provider, to

manage the custody operations for Wrapped Bitcoin (WBTC).

Coinbase is facing a $1 billion lawsuit

from BiT Global Digital Limited over its decision to delist Wrapped Bitcoin

(wBTC) in favor of its own competing product, cbBTC.

BiT Global claims that Coinbase's move

was an attempt to monopolize the wrapped Bitcoin market and undermine wBTC's

position.

Coinbase announced the delisting on

November 19, 2024, citing undisclosed failures to meet its standards, but BiT

Global argues that this decision was strategically timed to promote cbBTC.

The lawsuit filed on Dec 13, 2024, seeks damages exceeding $1

billion and injunctive relief to prevent further harm

BiT Global accuses Coinbase of

attempting to monopolize the wrapped Bitcoin market by delisting wBTC to

promote its own competing product, cbBTC.

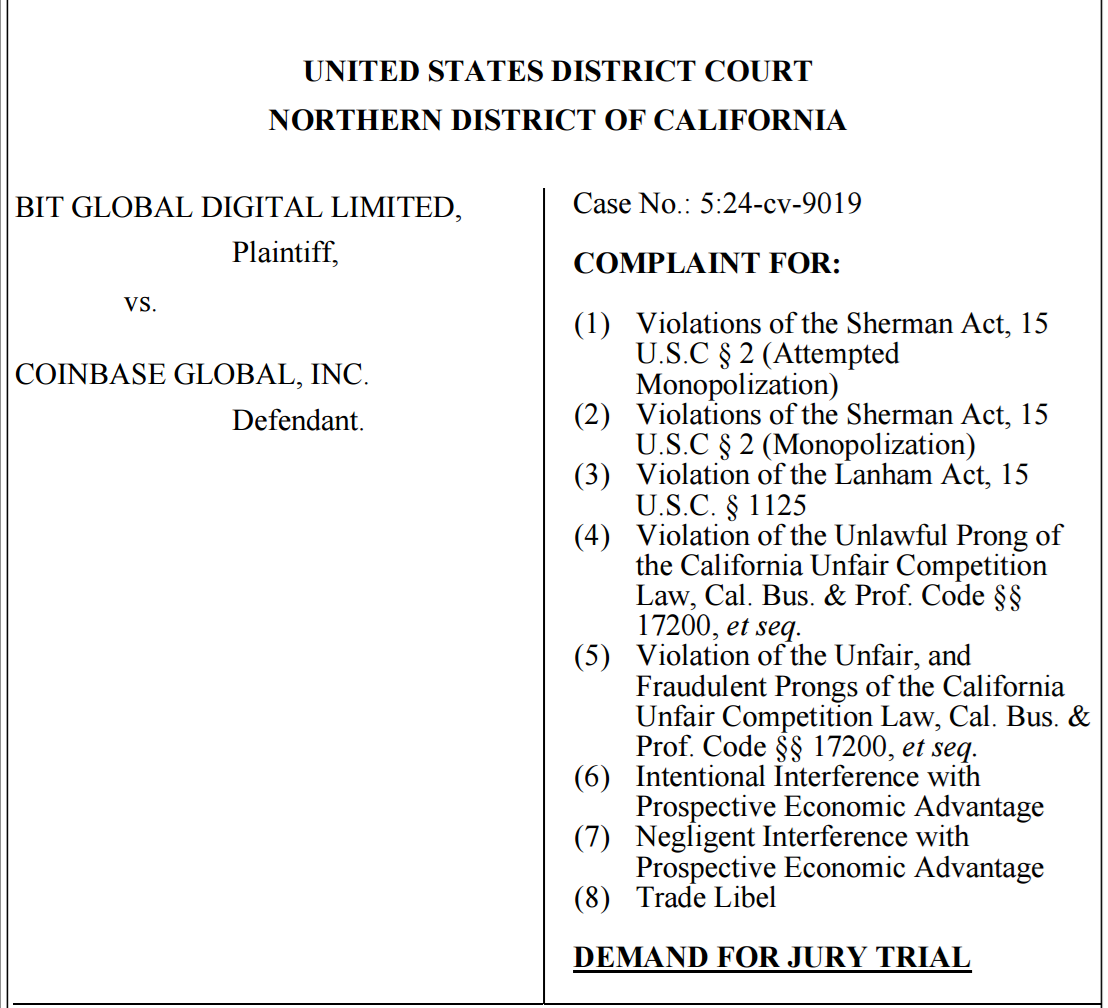

The lawsuit alleges violations of the

Sherman Act, predatory practices, and false statements about wBTC's compliance

with listing standards.

The Sherman Act prohibits monopolistic

practices and anti-competitive behavior.

The delisting of wBTC is claimed to

have resulted in massive financial losses for BiT Global and significant

erosion of consumer trust in wBTC.

BiT Global asserts that Coinbase’s

actions were deliberate, designed to weaken wBTC’s market position in favor of

cbBTC.

BiT Global accuses Coinbase of making

false claims that wBTC did not meet its listing standards, further damaging the

token’s reputation.

Coinbase cites its regular review

process to ensure listed assets meet stringent criteria.

It attributes the decision to suspend

wBTC trading to undisclosed failures to meet its standards, maintaining that

its actions are based on compliance and risk management, not anti-competitive

motives.

BiT Global's claims hinge on proving

Coinbase’s intent to monopolize the wrapped Bitcoin market. This requires

evidence that Coinbase deliberately acted to suppress competition and promote

its own product, cbBTC.

If the court finds merit in BiT

Global’s allegations, it could lead to regulatory scrutiny and potential

penalties against Coinbase.

Regardless of the lawsuit's outcome,

Coinbase’s reputation could suffer, particularly if the claims of

anti-competitive behavior resonate with its users or industry stakeholders.