2024-06-14

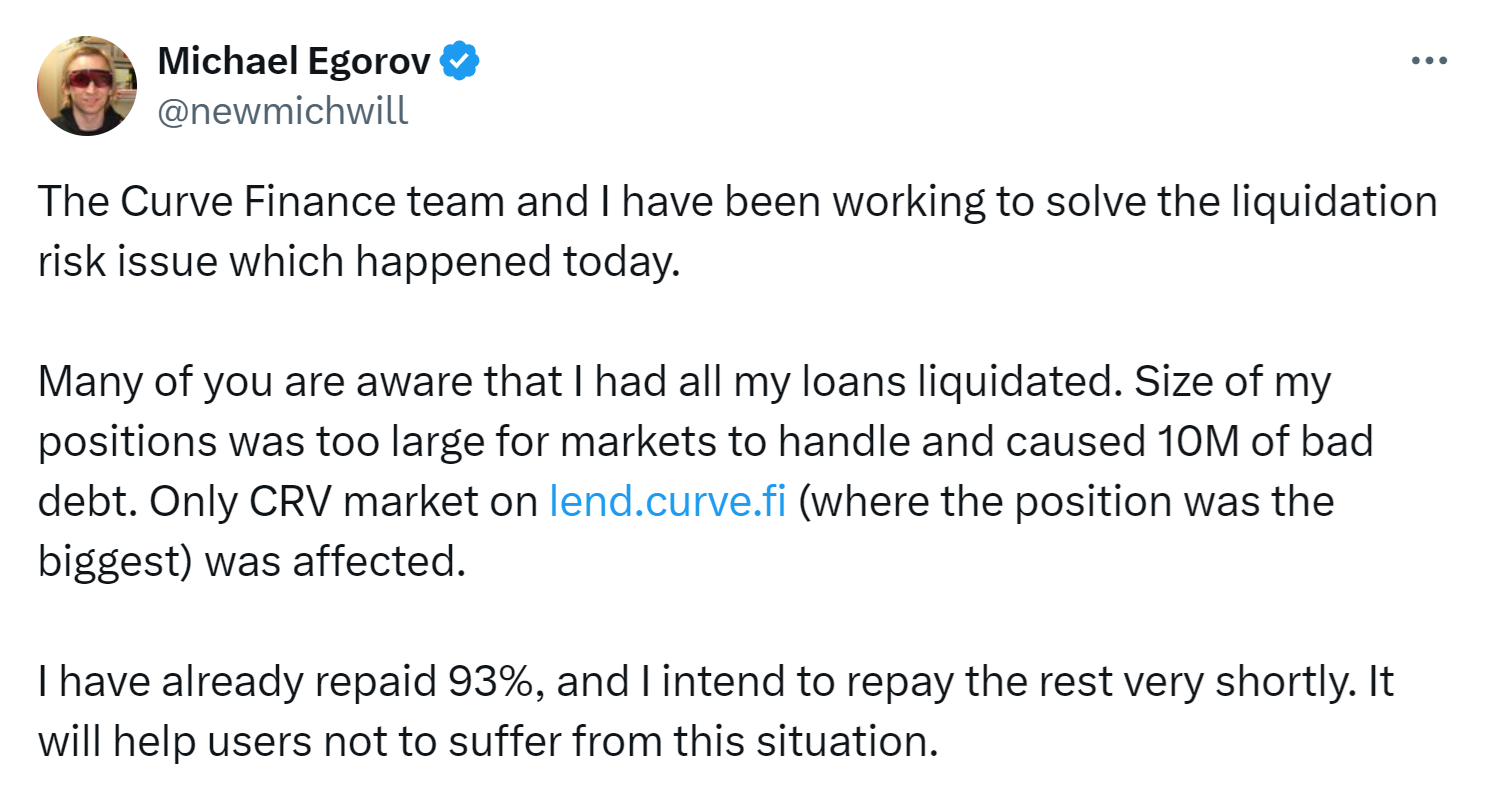

On June 13, 2024, DeFi loans associated

with Curve founder, Michael Egorov, faced liquidation.

This event led to a sharp 30% decline in the price of Curve’s native token, CRV.

The liquidation was triggered by a substantial loan against CRV tokens, where addresses linked to Egorov were borrowing nearly $100 million in various stablecoins against $140 million in CRV collateral.

As a result, on June 13, Curve founder’s

lending positions in DeFi platforms get liquidated and caused $10 million in

bad debt. Curve founder said he repaid 93% of bad debt.

Egorov borrowed stablecoins from DeFi platforms such as

Inverse, UwU Lend, Fraxlend, and Curve’s LlamaLend using CRV tokens as

collateral.

Egorov tried to reduce

risks. He repaid several loans on Inverse and Llamalend with FRAX, DOLA and CRV

tokens.

He conducted several swaps

between CRV and Tether's USDT.

As of June 14, 2024, CRV token 24 hours price up 8% but 7 days price down 37%.

There are 2 reasons that make CRV price

going downtrend.

First, there is no hype in DeFi tokens

such as CAKE, CRV, AERO, and RAY. Except for some tokens such as UNI and JUP.

Second, Curve Finance was hacked in

late July 2023. Although the hacking incident has ended for a long time. It

make Curve lost $1 billion in TVL since then.

Curve needs to have $3.255 billion in TVL to

get same number of TVL before the hacking incident happened. Now Curve has

$2.258 billion in TVL.