2024-05-07

DAI is a decentralized stablecoin. It the third largest stablecoin

by market cap after USDT and USDC.

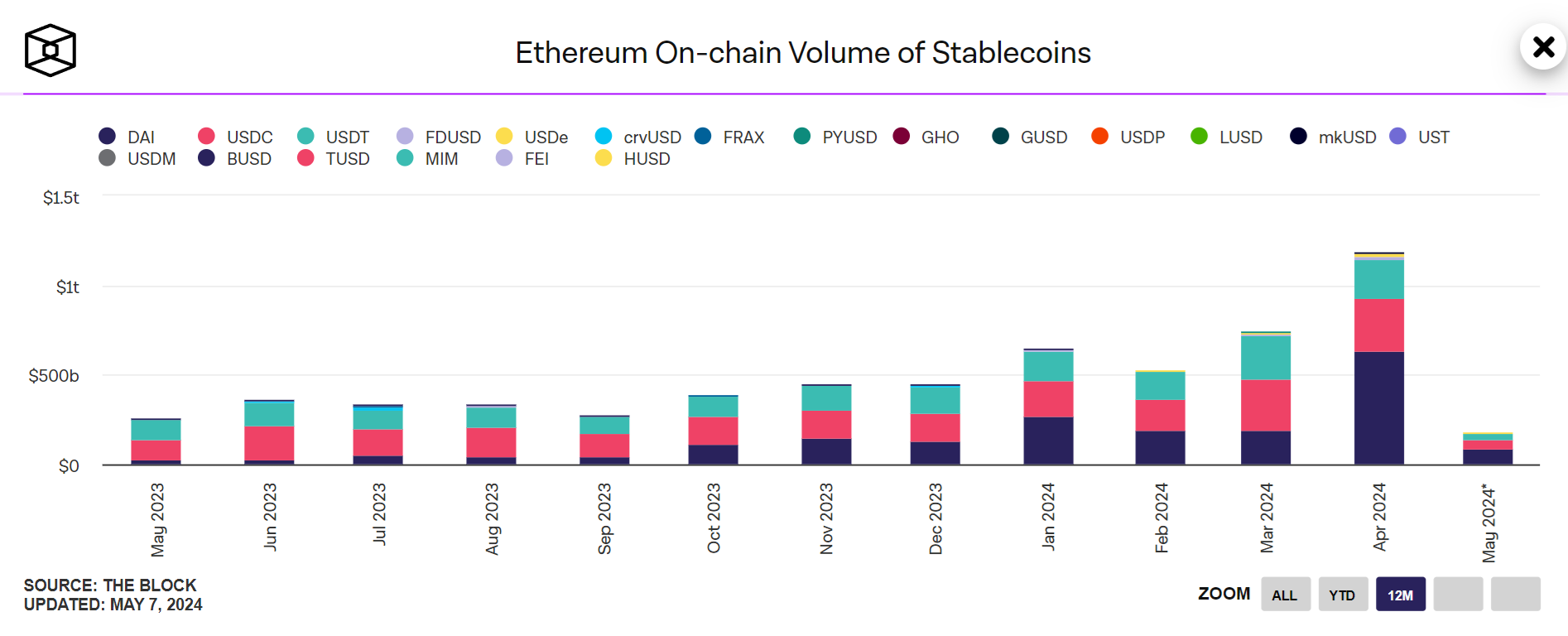

Dai monthly trading volume

May 2023- $23.61 billion

June 2023 - $29.41 billion

July 2023 - $53.67 billion

August 2023 - $43.99 billion

September 2023 - $44.13 billion

October 2023 - $111.99 billion

November 2023 - $151.15 billion

December 2023 - $131 billion

January 2024 - $270.83 billon

February 2024 - $194.59 billion

Mar 2024 - $187.89 billion

April 2024 - $636.72 billion

Ethereum On-chain Volume of Stablecoins (theblock.co)

DAI is the fastest growing stablecoin on Ethereum by trading volume

in April 2024

The increase in DAI’s trading volume come from flash loan activity.

Aave, Compound, and Binance offer flash loans.

What is DAI stablecoin?

Users can generate DAI by depositing

collateral assets into Maker Vaults within the Maker Protocol. This process

involves overcollateralization, ensuring that the value of DAI is backed by a

surplus of assets, which provides a buffer against market volatility.

The system is governed by MakerDAO, a

decentralized autonomous organization where decisions are made by MKR token

holders.

They vote on proposals affecting the

Maker Protocol's smart contracts, influencing factors like accepted collateral

types, collateralization ratios, and interest rates.

The MakerDAO community governs the

Maker Protocol by holding and voting with MKR tokens, which are also part of

the ecosystem. MKR token holders have the authority to propose and vote on

changes to the protocol, such as adjusting the stability fee, which is a sort

of interest rate charged on Dai generated against collateral, or adding new

types of collateral that can be used to generate Dai.

The stability of DAI's value is crucial

for its function in decentralized finance, where it's used for lending,

borrowing, and as a medium of exchange. Its design aims to offer the benefits

of digital currency without the typical volatility associated with

cryptocurrencies.

Dai stands out in the cryptocurrency

world due to its decentralized nature and the absence of a central authority

controlling its issuance. This makes it a key component of the decentralized

finance (DeFi) movement, which aims to create an open financial system

accessible to anyone.