2025-03-24

On March 21, 2025, Fidelity Investments launched a new

version of its Treasury money market fund that uses blockchain technology. The

new share class is called “OnChain”, and it will run on the Ethereum network.

sec.gov/Archives/edgar/data/917286/000113322825002995/ftdf-efp15119_485apos.htm#useof

Investors will be able to track their

fund shares on the Ethereum blockchain. However, Fidelity will still keep the official

records in its traditional system.

The blockchain record is for extra

transparency and will be updated daily.

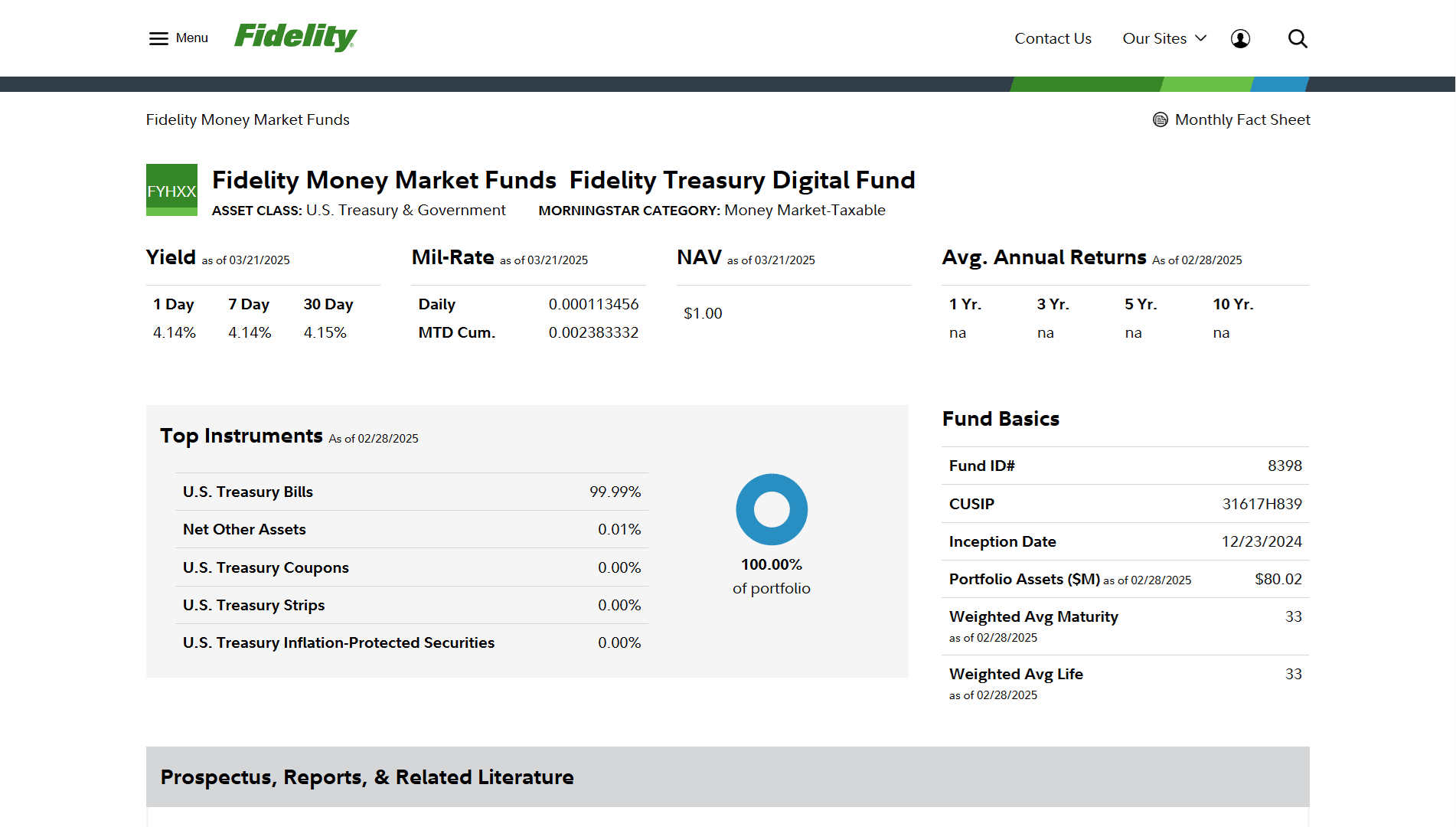

The fund itself invests in cash and

U.S. Treasury securities, aiming to provide income while keeping the investment

safe and easy to access.

The Treasuries themselves won’t be

tokenized — only the share ownership is being recorded on the blockchain.

Fidelity manages about $5.8 trillion

and is joining other major firms like BlackRock and Franklin Templeton in the

growing market for tokenized real-world assets — traditional financial products

that are recorded on blockchains.

The total value of tokenized U.S.

Treasuries is now around $4.77 billion, with most of it on Ethereum.

BlackRock leads the space with its BUIDL

fund, holding about $1.5 billion. Franklin Templeton has about $689 million in

a similar fund.

Fidelity’s new OnChain shares are

expected to launch on May 30, if approved by regulators.

Also, Fidelity has registered a Solana-based

fund, which suggests it may expand beyond Ethereum in the future.

Fidelity Treasury Digital Fund (FYHXX) | Fidelity Institutional