2025-02-13

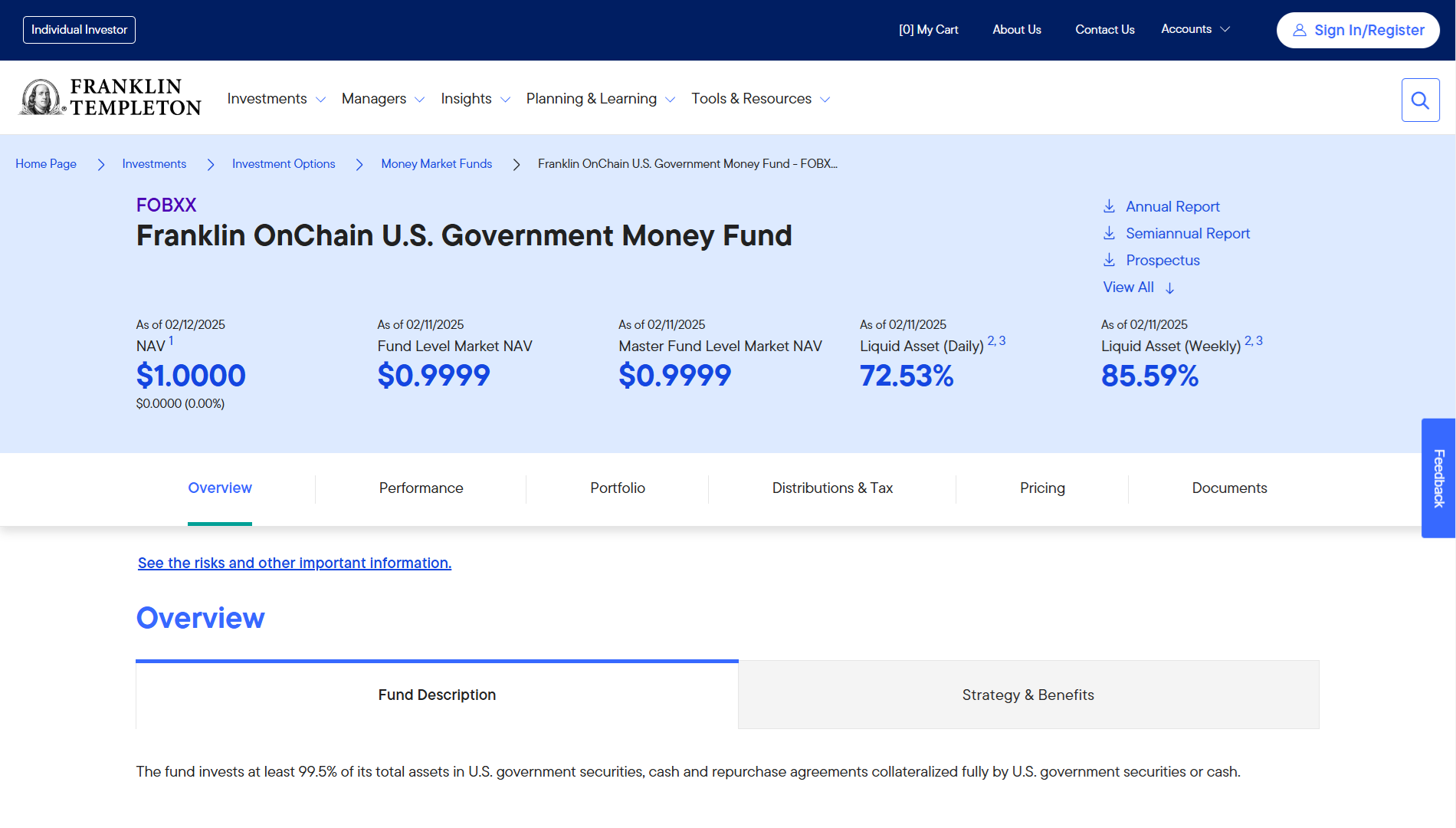

Franklin OnChain U.S. Government Money Fund - FOBXX

Franklin Templeton, a prominent global

investment management firm, has expanded its OnChain U.S. Government Money

Market Fund (FOBXX) to Solana, a popular blockchain network.

This fund, worth $594 million, is the third-largest

tokenized money market fund.

FOBXX is a tokenized fund, meaning its

shares are available on blockchain instead of traditional financial systems.

Before this, FOBXX was already on

Ethereum, Base (by Coinbase), Aptos, and Avalanche. But the main blockchain it

used was Stellar.

Now, Solana has been added to the list,

making it even more accessible.

Solana is growing fast in the crypto

world. It’s becoming a top choice for new tokens and decentralized trading.

In late 2023, Solana had only 1% of new

token launches, but now it has over 90%.

Institutional investors believe in

Solana’s speed and efficiency, which makes it attractive for financial products

like FOBXX.

Tokenization (turning real-world assets

like money, bonds, and stocks into digital tokens) is a huge trend in crypto.

Ethereum is still the leader, with $3.8

billion worth of tokenized assets, while Solana is ranked seventh with $135

million.

Experts think this is a trillion-dollar

opportunity because it makes financial transactions faster, cheaper, and more

transparent.

Franklin Templeton moving its fund to Solana

is another big step for blockchain adoption. It shows that more financial

institutions are trusting crypto technology to manage traditional assets.