2024-12-04

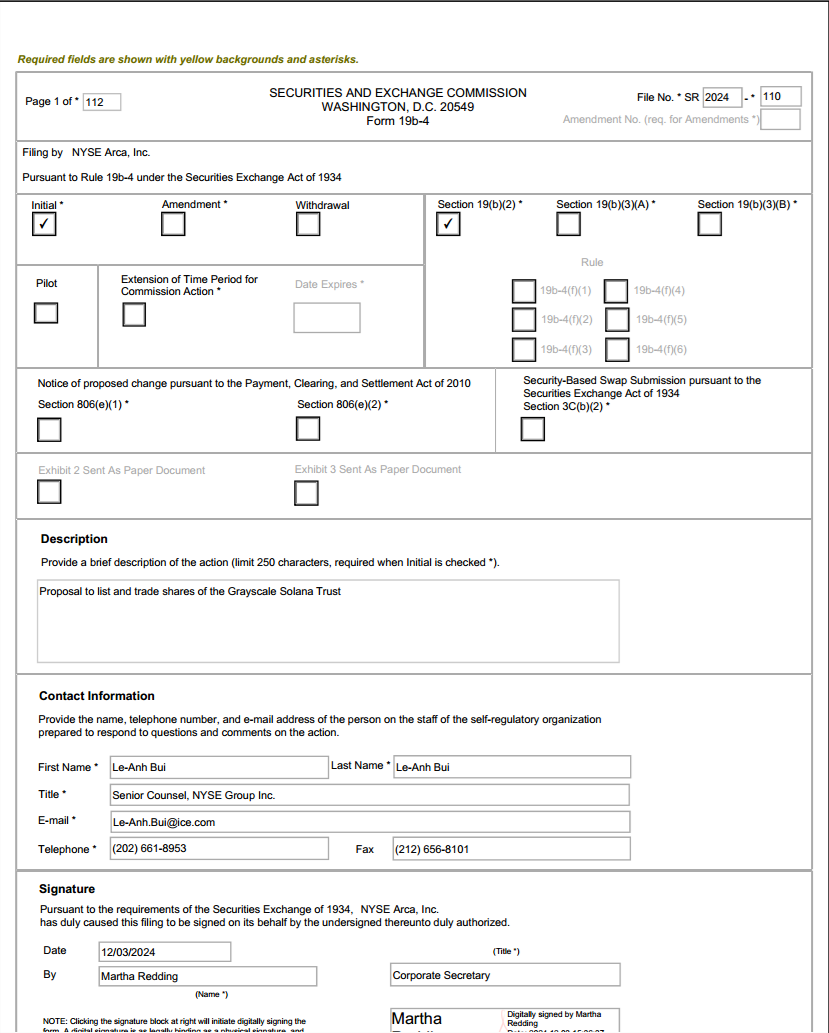

Grayscale Investments has filed with

the U.S. Securities and Exchange Commission (SEC) to launch a spot Solana ETF.

If approved, the Grayscale Solana Trust, under the ticker GSOL, would trade on

the New York Stock Exchange (NYSE).

This move follows Grayscale's previous

conversions of its spot Bitcoin (BTC) and Ether (ETH) trusts into ETFs.

The filing on Dec. 3 outlines plans to

convert the existing Grayscale Solana Trust into a spot ETF, mirroring similar

conversions the company has achieved for its Bitcoin (BTC) and Ether (ETH)

trusts.

The filing indicates that the Grayscale

Solana Trust is the world's largest Solana investment fund by assets under

management, holding roughly $134.2 million. The custodian for the ETF would be

Coinbase Custody, while BNY Mellon Asset Servicing would serve as the

administrator and transfer agent.

The Grayscale Solana Trust currently manages $134.2 million in assets, making it the world's largest Solana investment fund by assets under management. The Trust's holdings represent about 0.1% of all Solana (SOL) tokens in circulation.

Alongside the 19b-4 filing (informing

the SEC of the proposed rule change), Grayscale must submit an S-1 registration

statement for final approval. An approved S-1 would allow GSOL to trade on a

public stock exchange.

Grayscale joins a growing list of firms

pursuing SEC approval for a spot Solana ETF, including 21Shares, Canary

Capital, VanEck, Bitwise, and potentially Franklin Templeton. The increasing

competition coincides with Solana's dramatic 277% price increase over the past

year, driving its market cap above $112 billion.

As of Dec. 4, Solana has a market cap

of $113.6 billion. This makes Solana the world's 5th most valuable crypto by

market cap.