2025-02-01

blog.kraken.com/news/kraken-2024-financials

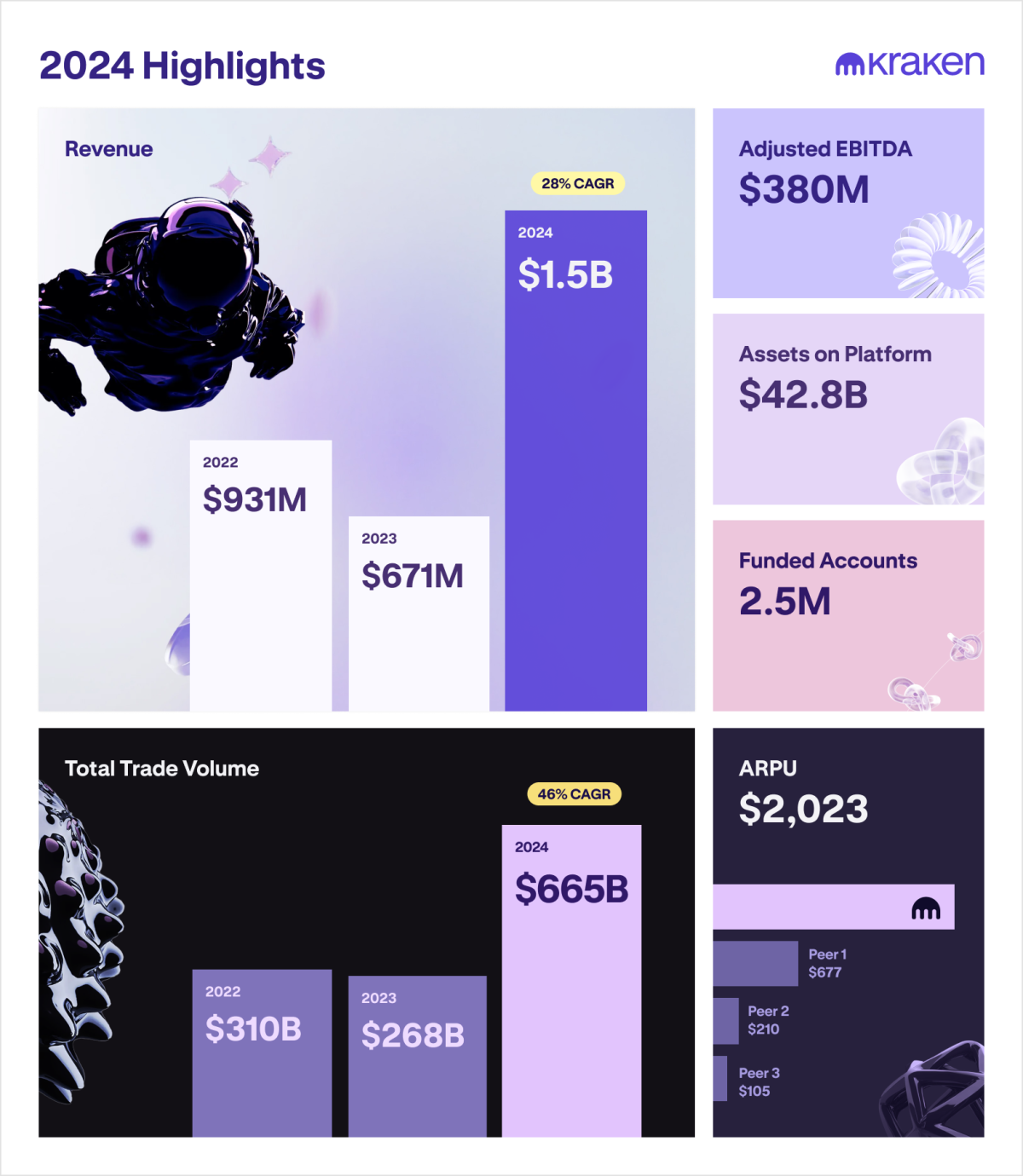

Kraken, one of the world's leading

cryptocurrency exchanges, has reported a staggering 128% revenue increase in

2024, bringing total earnings to $1.5 billion.

The latest financial report also

highlights a series of strategic shifts that have propelled the company’s

growth, including an expansion of core services and a renewed focus on customer

offerings.

Kraken’s 2024 earnings reveal growth in

multiple key areas.

The exchange now holds $42.8 billion in

customer assets and maintains an average revenue of over $2,000 per customer.

Its earnings before interest, taxes,

depreciation, and amortization (EBITDA) reached $380 million, reinforcing the

company’s financial strength.

The trading volume on the platform also

soared to $665 billion for the year, supported by over 2.5 million funded

accounts.

These figures demonstrate Kraken’s

sustained momentum in the crypto market despite regulatory challenges and

industry shifts.

A notable development for Kraken in

2024 was the restoration of its staking services in the United States,

following a two-year suspension.

The exchange had halted its staking

offerings after a $30 million settlement with the U.S. Securities and Exchange

Commission (SEC) in 2023, which accused the company of selling unregistered

securities through its staking program.

Now, Kraken has resumed staking

services in 37 states, covering 17 digital assets, including Ethereum (ETH),

Solana (SOL), and Polkadot (DOT).

The firm also made headlines in

December when it was chosen by the FTX bankruptcy estate to facilitate

distributions to former customers and creditors of the defunct exchange.

These payments, scheduled for early

2025, may contribute to increased trading activity as former FTX users

reintegrate into the market.

Amid speculation about a potential

public offering, Kraken has been identified by ETF issuer Bitwise as a likely

candidate for a stock market debut in 2025.

If the listing materializes, Kraken

will join other major crypto firms like Circle and Chainalysis in entering

traditional financial markets.

Additionally, the exchange has

continued to expand its trading services, launching new perpetual and quarterly

futures contracts for key cryptocurrencies.

Plans to enhance margin trading

services are also underway, offering traders increased flexibility and higher

leverage options.

In November, Kraken announced the

closure of its non-fungible token (NFT) marketplace, just one year after its

launch.

The decision, according to company

representatives, aligns with a broader strategic effort to refine service

offerings and concentrate on high-growth areas within the business.

The decision due to a sharp decline in NFT sales volumes throughout 2024, which fell from $3.6 billion in January to below $1 billion in September.

Kraken’s financial performance indicating positive crypto regulation under the Trump administration. Furthermore, Kraken is considering IPO in the future.