2025-02-26

On February 24, 2025, Nasdaq, a major

U.S. stock exchange, has applied to list shares of the Grayscale Polkadot Trust

(DOT) as an exchange-traded fund (ETF) that holds Polkadot’s (DOT)

cryptocurrency.

If approved by the U.S. Securities and

Exchange Commission (SEC), this ETF will allow investors to gain exposure to

Polkadot without directly buying the cryptocurrency.

This is part of Grayscale’s ongoing

effort to expand its publicly traded crypto funds. Many other companies are

also waiting for SEC approval to launch ETFs for different cryptocurrencies,

known as altcoins.

Grayscale’s Growing Crypto Funds

Grayscale, a well-known crypto investment company, already offers

ETFs for:

It has also applied for ETFs based on:

The company is also working on an ETF that holds multiple

cryptocurrencies at once.

Grayscale has launched several investment funds in recent months:

What is Polkadot?

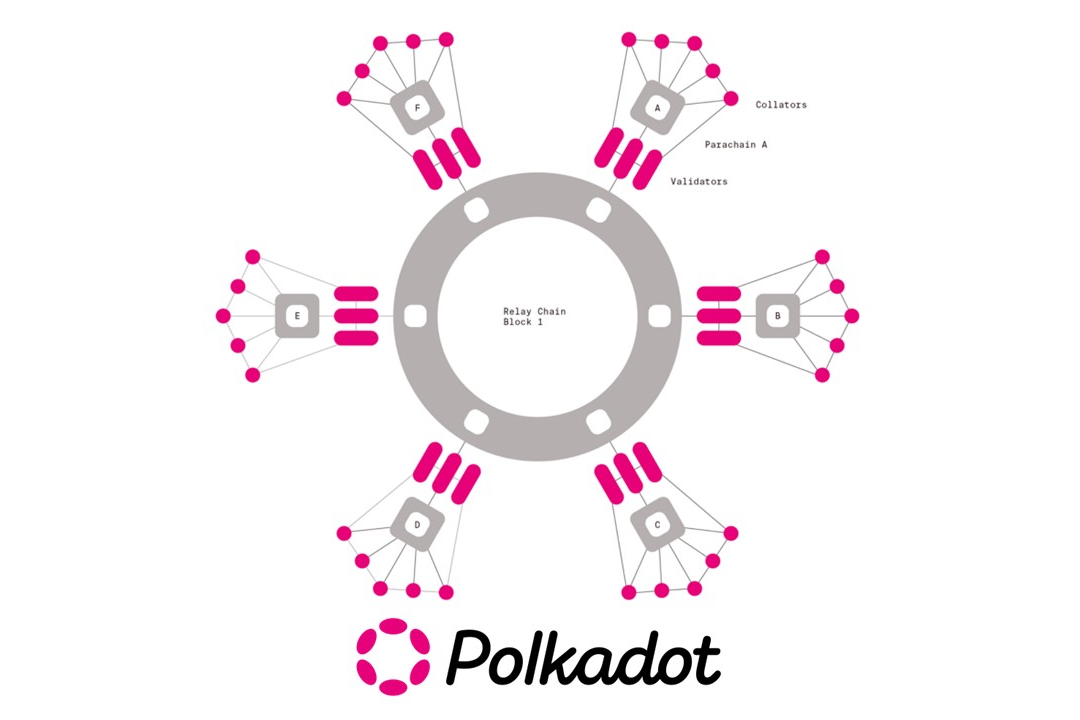

Polkadot is a blockchain platform

launched in 2020 that allows different blockchains to work together. It helps

transfer data and assets across networks, solving scalability and

interoperability issues.

SEC’s Changing Crypto Policy

The SEC has been cautious about

approving crypto ETFs. While it approved Bitcoin and Ethereum ETFs in 2024, it

has been slower in allowing ETFs for other cryptocurrencies.

With Donald Trump’s second term as U.S.

President, the SEC’s approach to crypto has softened. Experts believe the

chances of new ETFs being approved have increased: