2022-11-14

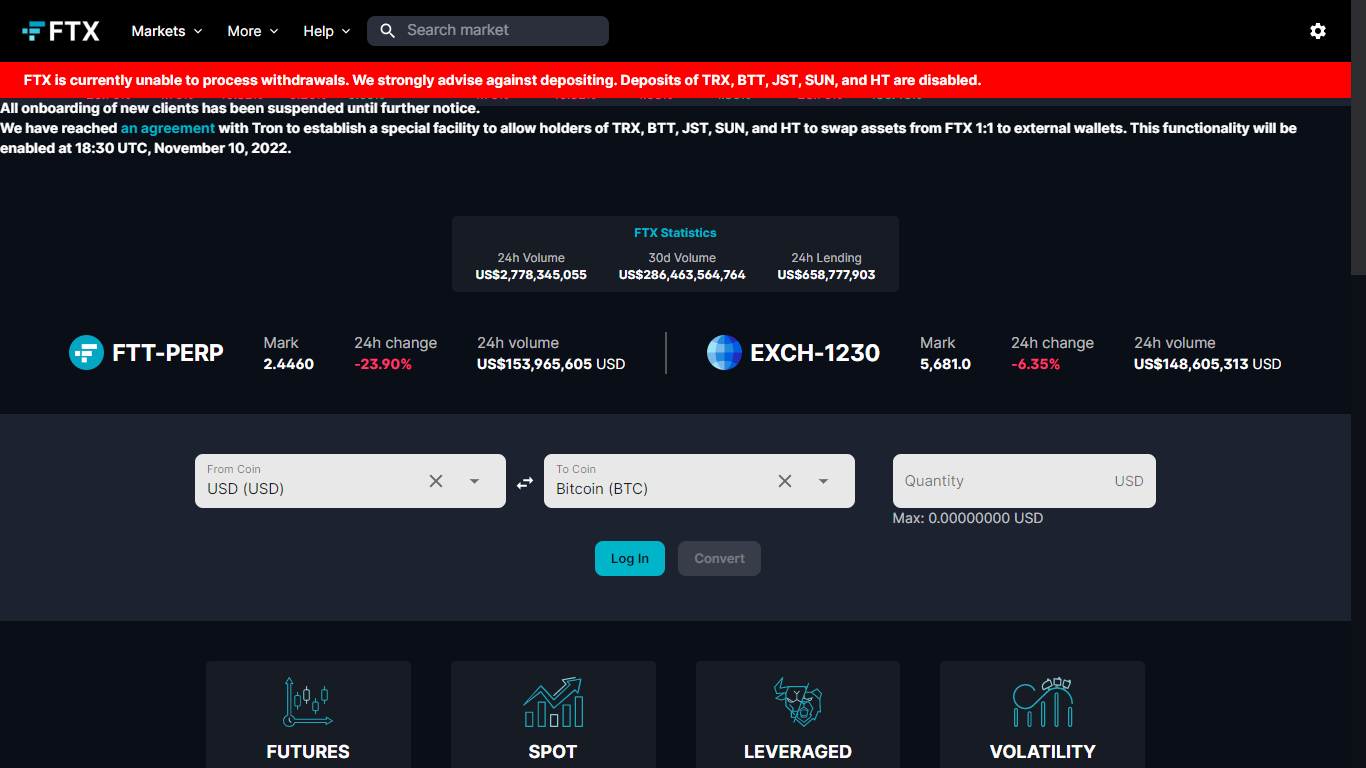

FTX had $16 billion in customer assets but only $6 billion could withdraw

from the platform. Before FTX and FTX US filed for bankruptcy. $6 billion of

withdrawals were made in 72 hours amid investors’ panic. Due to the lack of

liquidity, FTX went bankrupt.

Before $6 billion were withdrawn, FTX has only ten of millions of

dollars for daily withdrawal.

FTX exchanges provided $10 billion loans to another company own by Sam

Bankman-Fried, Alameda Research. This company is a trading quant firm, it trade

leverage trading, invest in DeFi, and cryptocurrency projects. FTX paused

withdrawal after just $6 billion worth of funds were withdrawn.

An exchange has the responsibility to safeguard customer deposits

and it should only make profits from customer commissions and transaction fees.

FTX violated its own term of service and misused customer funds.

Out of $10 billion transferred to Alameda Research $1.7 billion disappeared

from the company balance sheet.

Sam Bankman-Fried bought 56,273,469 shares of Robinhood stock, which

worth at least $460 million. On November 2, 2022 Alameda Research held $292

million of unlocked SOL, $863 million of locked SOL, and $41 million of SOL

collateral.

After massive withdrawal event. Sam Bankman-Fried held a meeting at Nassau, Bahamas. To look at the company’s financial statement to find out how much cash FTX need to cover the hole. There were news out there that Sam Bankman-Fried needed $8 billion to cover the shortfall. It can be in form of acquisition from another company or issue a right offering. However, there was no sign of bailout from anyone.

FTX was ranked at the top three cryptocurrency exchanges, the other two are Binance and Coinbase. The fall of FTX has been making cryptocurrency market in turbulence. Bitcoin plummet by 23% in 7 days. Whereas, Solana FTX’s back cryptocurrency went down 60% in 7 days. From Novomber 7, 2022 to November 14, 2022.