2025-02-27

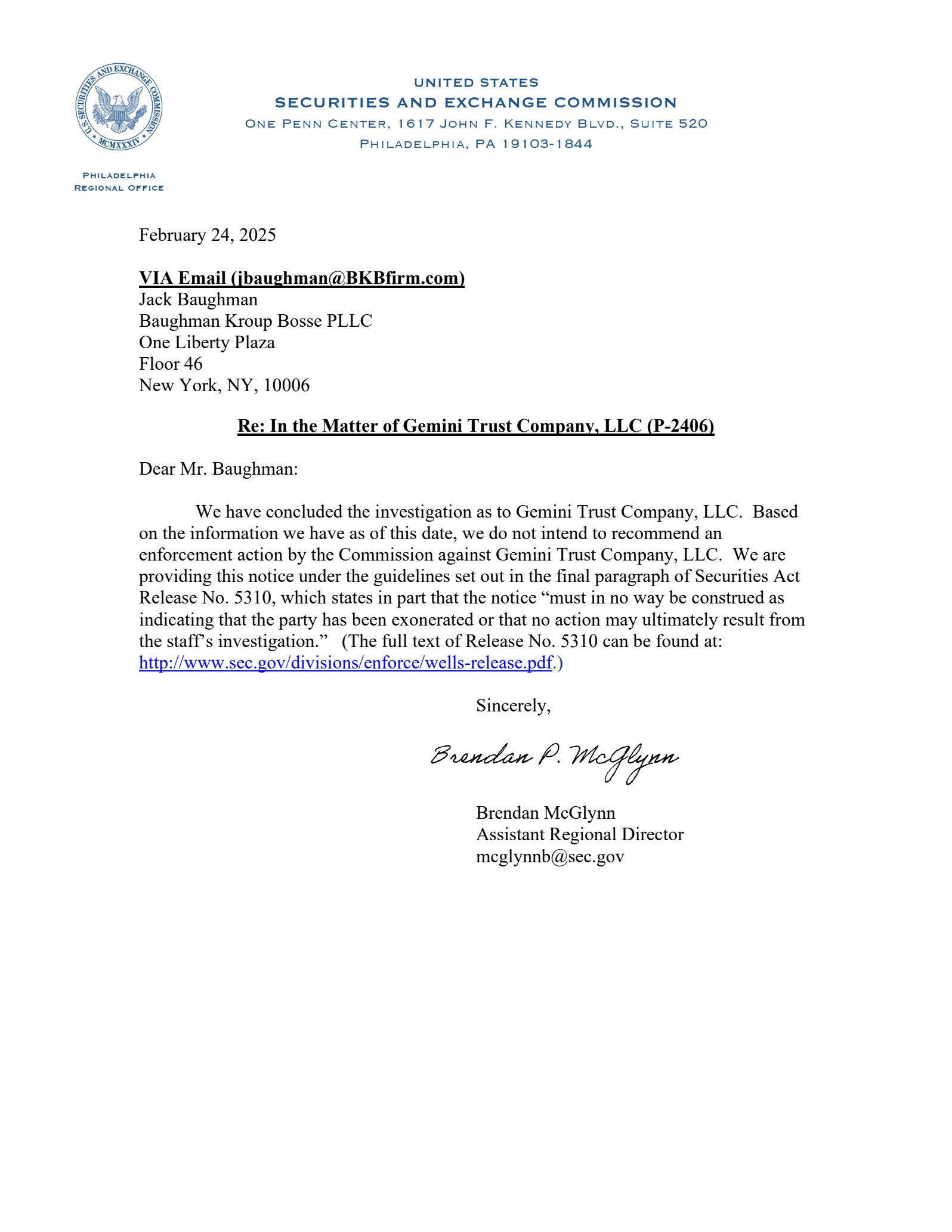

On Feb 24, 2025, the U.S. Securities

and Exchange Commission (SEC) has closed its investigation into the

cryptocurrency exchange Gemini without taking any action.

This decision is part of a trend where

the SEC has recently dropped cases against other crypto companies.

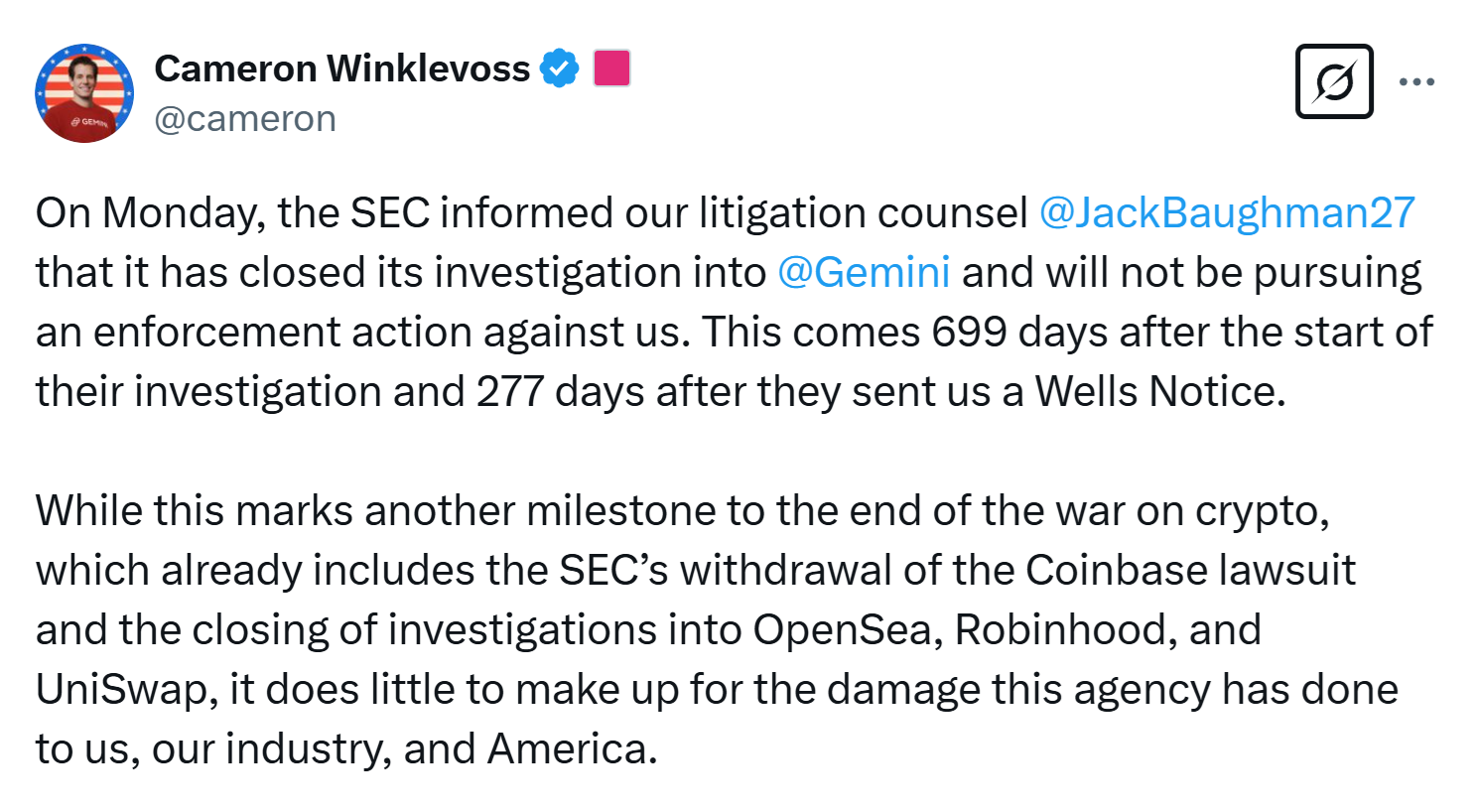

On February 26, Gemini co-founder

Cameron Winklevoss shared that the SEC had ended its investigation.

The SEC had previously accused Gemini

and Genesis Global Capital of offering unregistered securities through Gemini’s

"Earn" program in January 2023.

While the investigation is closed for

now, the SEC clarified that this does not mean they won’t take action in the

future.

Winklevoss welcomed the news but said

it doesn’t undo the damage caused by the SEC’s actions.

He claimed that Gemini spent tens of

millions of dollars on legal fees. The broader crypto industry lost hundreds of

millions in productivity, creativity, and innovation. Many engineers and

entrepreneurs may have avoided working in crypto due to regulatory uncertainty.

The SEC recently ended cases against

Coinbase, OpenSea, Robinhood Crypto, and Uniswap Labs.

These cases were part of the SEC’s

strict enforcement against crypto companies, led by former SEC Chair Gary

Gensler, who resigned in January 2025.

Winklevoss believes the crypto industry

needs better protection from regulatory overreach.

He suggested:

Reimbursement – If the SEC opens an

investigation without clear rules, they should pay back companies’ legal costs.

Accountability – SEC staff responsible

for unfair actions should be publicly fired.

Banning Bad Actors – Officials who

misuse their power should be barred from working in government agencies again.

He warned that unless these steps are

taken, similar regulatory actions could happen again, affecting not just crypto

but other emerging industries.

Despite everything, Winklevoss said he

remains hopeful that the crypto industry can move forward and create a fairer

system for the future.