2025-04-25

The U.S. Securities and Exchange

Commission (SEC) is taking more time to decide whether to approve a proposed

ETF (exchange-traded fund) of Polkadot’s native token, DOT.

In a filing on April 24, the SEC said

it will delay its decision until June 11.

This is nearly four months after Nasdaq

asked to list the Grayscale Polkadot Trust on February 24.

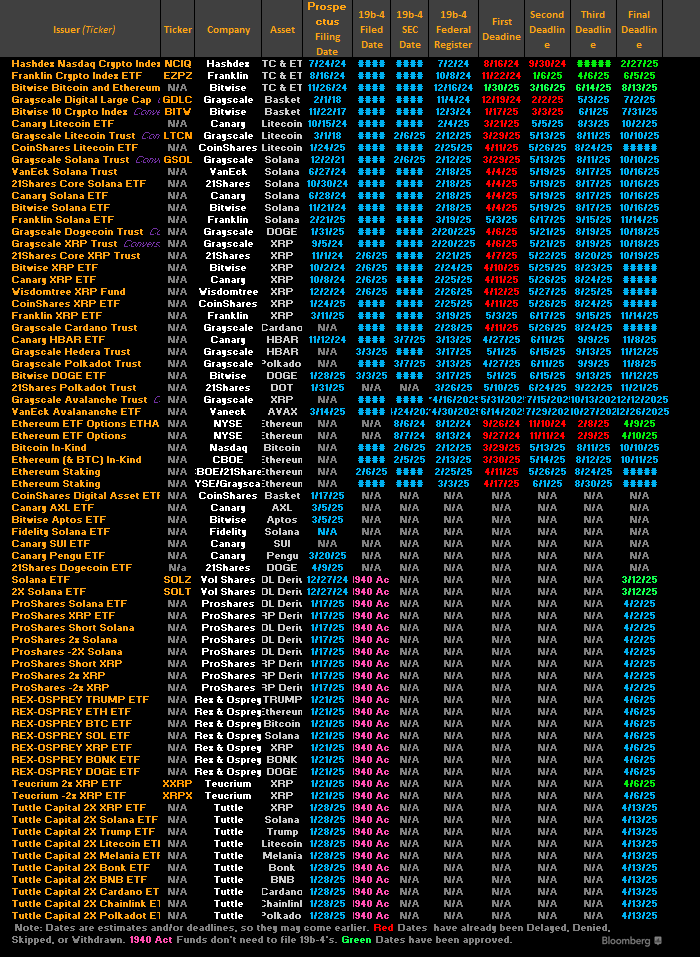

Grayscale’s Polkadot ETF is one of 72 crypto-related ETFs waiting for SEC approval.

These include ETFs for popular

cryptocurrencies like Solana, XRP, and Litecoin, as well as memecoins like

Dogecoin.

Another company, 21Shares, is also

trying to get approval for its own Polkadot ETF.

Polkadot is a blockchain network

launched in 2020. As of April 24, its token DOT had a market value of around

$6.6 billion.

Growing Interest in Crypto ETFs

Grayscale already manages other crypto

ETFs, including those for Bitcoin and Ether. It has also applied for ETFs for

other tokens like Solana, Litecoin, XRP, Dogecoin, and Cardano.

The push for more crypto ETFs comes as

more than 80% of institutional investors say they plan to increase their crypto

investments in 2025, according to a report by Coinbase and EY-Parthenon.

Still, experts say that while Bitcoin

and Ether ETFs have strong demand, altcoin ETFs might attract less interest.

As Bloomberg analyst Eric Balchunas put

it, having a token in an ETF is like having your song added to streaming

services. It doesn’t mean people will listen, but it gives you a better chance

to be seen.