2024-11-28

Tether has decided to discontinue its

euro-pegged stablecoin, EURT, by November 27, 2025.

The decision was influenced by the

evolving regulatory frameworks in Europe, particularly the Markets in

Crypto-Assets (MiCA) regulations.

Tether has asked EURT holders to redeem their tokens within the given timeframe. Tether customers holding EUR₮ advised to redeem tokens by November 2025.

Tether, the issuer of USD₮ (USDT), the

world’s largest stablecoin by market

capitalization, has announced it will discontinue its euro-pegged stablecoin

EUR₮ (EURT).

The decision comes as part of the

company’s strategic realignment, citing

evolving regulatory conditions in Europe.

The firm revealed the move in an

official statement on November 27, asking EUR₮ holders to

redeem their holdings within a year, with a deadline set for November 27, 2025.

Tether has already ceased minting EUR₮ tokens, with

the last issuance request processed in 2022.

Regulatory Challenges in Europe

Tether’s decision is influenced by the

European Union’s emerging stablecoin regulations, particularly the Markets in

Crypto-Assets (MiCA) regulation, which is expected to come into full effect by

the end of 2024.

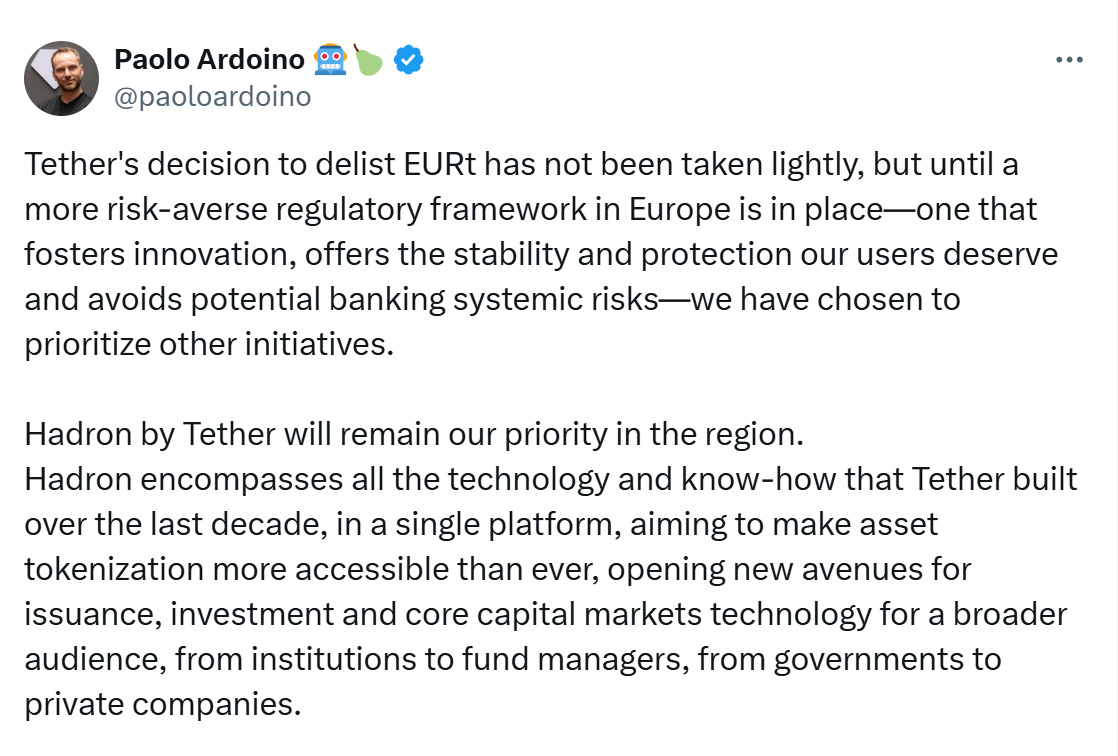

The company stated that until a

"more risk-averse framework is in place — one that fosters innovation and

offers stability and protection," it has chosen to prioritize other

initiatives.

Tether CEO Paolo Ardoino has previously

voiced concerns over MiCA, warning of potential systemic risks the regulations

could pose to stablecoins.

Focusing on MiCA-Compliant Alternatives

Tether will now focus on supporting new

projects that comply with MiCA regulations, such as EURQ and USDQ stablecoins

developed by Quantoz Payments, which are designed to comply with MiCA

regulations.

These tokens will leverage Tether’s

Hadron technology, a robust solution simplifying stablecoin creation and

management while ensuring compliance with anti-money laundering (AML)

standards.

The Hadron platform also supports

tokenization of diverse assets, such as stocks, bonds, and loyalty points.

Tether emphasized that investments in such projects align with its mission to redefine financial services, offering tools that enhance user adaptability and promote inclusivity in the global economy.

About EUR₮ and User

Redemption

Introduced in 2016, EUR₮ was pegged 1:1

to the euro, providing a stable alternative for users in a volatile

cryptocurrency market.

However, with a current market

capitalization of $27 million—accounting for

just 0.02% of Tether’s total

stablecoin market cap—the company has

decided to shift resources to higher-priority ventures.

Tether has reassured EUR₮ holders that

they can redeem their assets within the stipulated timeframe.