2025-01-23

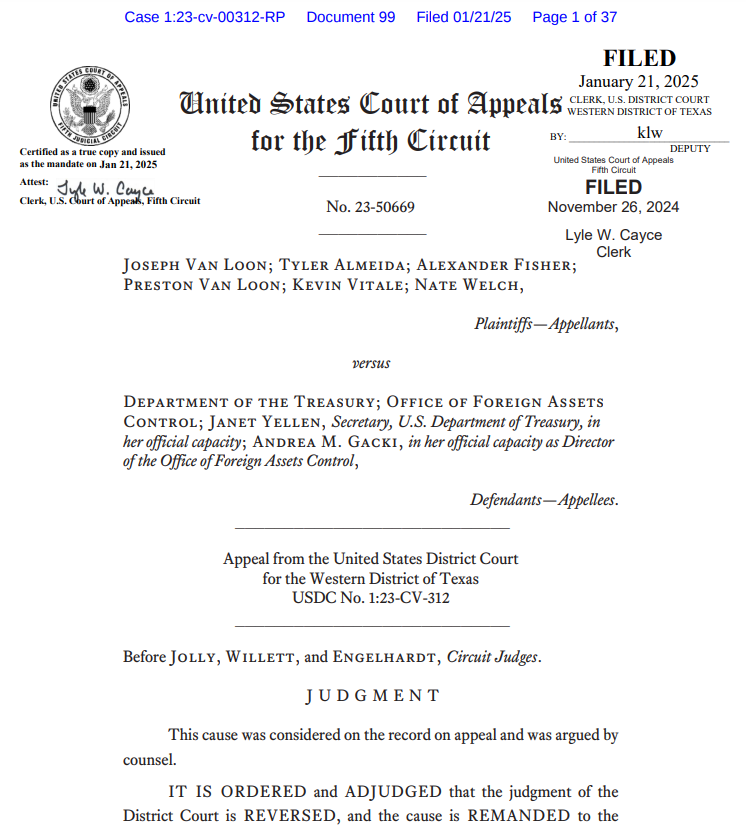

On January 21, 2025, in a landmark

decision, the U.S. District Court for the Western District of Texas has

overturned sanctions imposed by the Treasury’s Office of Foreign Assets

Control (OFAC) on the cryptocurrency mixing protocol Tornado Cash

since August 2022.

The court's decision comes after an

appeal by Tornado Cash users, which highlighted alleged overreach by the Office

of Foreign Assets Control (OFAC) under the U.S. Treasury Department.

The revocation of sanctions triggered a

surge in the value of Tornado Cash’s native token, TORN.

Data from CoinMarketCap revealed that

TORN's price skyrocketed by over 100% following the ruling, trading at $16.71.

The trading volume of the token also surged by an extraordinary 5,500%, exceeding $8 million in 24 hours.

Background on Sanctions and Court

Ruling

The sanctions, introduced by OFAC in

2022, accused Tornado Cash of facilitating over $455 million in cryptocurrency

laundering for North Korea's Lazarus Group, along with other cybercriminal

activities.

OFAC cited that over $7 billion had

passed through the protocol since its inception in 2019, with approximately 30%

of the funds linked to illegal activities.

However, the court ruled that OFAC

exceeded its statutory authority by sanctioning Tornado Cash.

The U.S. Fifth Circuit Court of Appeals

in New Orleans argued in November 2023 that smart contracts, a central

component of Tornado Cash, could not be considered property under the

International Emergency Economic Powers Act (IEEPA).

The three-judge panel concluded that

blacklisting the entire protocol rather than targeting individual bad actors

was unjustified.

Paul Grewal, Chief Legal Officer of

Coinbase, applauded the decision, stating that lifting sanctions would allow

U.S. crypto users to utilize Tornado Cash's privacy tools.

He further criticized OFAC's approach,

emphasizing the importance of protecting open-source technology and

privacy-preserving software.

Mixed Reactions Within the Crypto

Community

The ruling has been celebrated within

the crypto community as a victory for decentralized finance and privacy

advocates.

Crypto trader Ash Crypto speculated

that the decision reflects a pro-crypto stance under the Trump administration,

which has promised looser regulations for the industry.

Industry experts, including AlephZero

President Matthew Niemerg, stressed that compliant privacy-preserving software

would be critical for future protocols. However, concerns persist over the

potential misuse of such tools by malicious actors.

Tornado Cash Developer Remains in

Custody

The sanctions led to the arrest of

Tornado Cash developer Alexey Pertsev.

He was found guilty of money

laundering by Dutch judges at the s-Hertogenbosch Court of Appeal on May 14,

2024.

Pertsev was sentenced to five years and

four months in prison for laundering $1.2 billion in illicit assets through Tornado

Cash.

Despite the legal victory for Tornado

Cash users, its developer Alexey Pertsev remains in custody.

Pertsev, who was arrested by Dutch

authorities in 2022, was sentenced to five and a half years in prison for

laundering over $1.2 billion using the protocol.

Prosecutors argued that Pertsev failed

to prevent illicit use of the platform, while his defense maintained that he

had no control over user activities.

The court's decision marks a pivotal

moment in the battle between regulators and privacy-focused crypto projects.

While the lifting of sanctions has reinvigorated Tornado Cash’s community,

questions remain about how governments can balance the need for financial

privacy with preventing illicit activity.

The crypto world now waits to see how

this ruling shapes the future of regulation and innovation in the sector.