2025-02-04

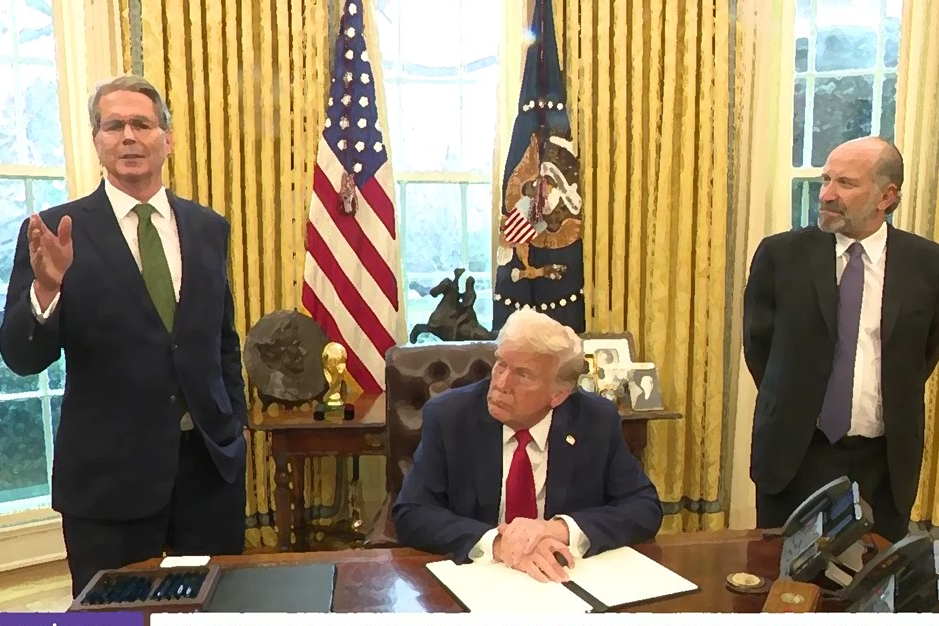

February 3, 2025 – U.S. President

Donald Trump has signed an executive order directing the establishment of a

U.S. sovereign wealth fund.

The order mandates that the fund be

created within the next 12 months and leaves open the possibility that it could

be used to acquire the Chinese-owned short-video app TikTok.

The announcement comes amid ongoing

speculation regarding the future of TikTok, which has 170 million American

users.

Trump has previously stated that he is

in discussions with multiple parties regarding the platform’s ownership and

expects a decision on its fate later this month.

The executive order instructs the

Treasury and Commerce Departments to submit a comprehensive plan within 90

days, outlining potential funding mechanisms, investment strategies, governance

models, and structural details for the sovereign wealth fund.

However, the text of the order provides

little clarity on how the fund would be financed. On the other hand, the U.S.

government still has budget deficit and has a lot of debt to GDP.

Historically, sovereign wealth funds

are financed through budget surpluses or revenues from natural resources.

However, Trump has suggested tariffs as

a possible source of funding, though this approach remains unconfirmed by

administration officials.

Establishing such a fund may also

require congressional approval, adding a layer of complexity to its

implementation.

One potential pathway for the fund's

creation is repurposing the U.S. International Development Finance Corporation

(DFC), which currently works with private investors to fund development

projects globally.

The Trump administration has considered

transitioning the DFC into a sovereign wealth fund model in recent months.

In a related development, Trump

announced his nomination of Benjamin Black to lead the DFC.

Black, a managing partner at Fortinbras

Enterprises, is the son of Leon Black, co-founder of asset management giant Apollo

Global Management.

Following the executive order, Wyoming

Senator Cynthia Lummis posted on X, hinting that the new fund could have

invested in Bitcoin (BTC).

While Trump, Treasury Secretary Scott

Bessent, and Commerce Secretary Howard Lutnick did not directly confirm any

crypto-related investments, Lummis suggested that Bitcoin could be among the

asset classes considered for the fund.

The idea of a U.S. sovereign wealth

fund investing in Bitcoin aligns with growing institutional interest in the

cryptocurrency, but whether such a move would be part of the administration’s

strategy remains to be seen.

If successfully established, the U.S.

sovereign wealth fund would join more than 90 similar funds worldwide, which

collectively manage over $8 trillion in assets.

Many of the largest sovereign funds are

based in the Middle East and Asia, where they leverage government capital to

make strategic investments in industries ranging from technology to

infrastructure.

Further details are expected once the

Treasury and Commerce Departments submit their plans in the coming months.