2025-01-28

Tuttle Capital Management has filed for

10 leveraged cryptocurrency exchange-traded funds (ETFs), including products

tracking XRP, Solana, and memecoins associated with former U.S. President

Donald Trump and First Lady Melania Trump.

The filing, submitted Monday afternoon,

marks a development in the ETF space as these products aim to provide amplified

returns based on the performance of their underlying cryptocurrencies.

The proposed ETFs also include funds

tied to Litecoin, Cardano, Chainlink, Polkadot, BNP, and Bonk. According to

Bloomberg Intelligence analyst James Seyffart, these filings represent the

first-ever exchange-traded product (ETP) applications for Chainlink, Cardano,

Polkadot, BNP, and the Melania memecoin.

A leveraged ETF uses financial

derivatives and debt to magnify the daily returns of its underlying asset,

typically aiming for a 2:1 ratio or higher.

Unlike traditional ETFs that track

their underlying index on a one-to-one basis, leveraged ETFs seek to amplify

the performance or inverse performance of their benchmarks.

The filing falls under the 40 Act, which means these ETFs could potentially be trading by April unless disapproved by the Securities and Exchange Commission (SEC), Bloomberg ETF analyst Eric Balchunas noted.

Tuttle Capital has previously launched

innovative ETF products, including leveraged funds offering 200% exposure and

-200% inverse exposure to the daily price movement of MicroStrategy, the

largest corporate holder of Bitcoin.

This latest filing highlights growing

interest in leveraging crypto investments in the ETF market, while also

reflecting the rising influence of memecoins in the financial space. Whether

the SEC will approve these products remains to be seen.

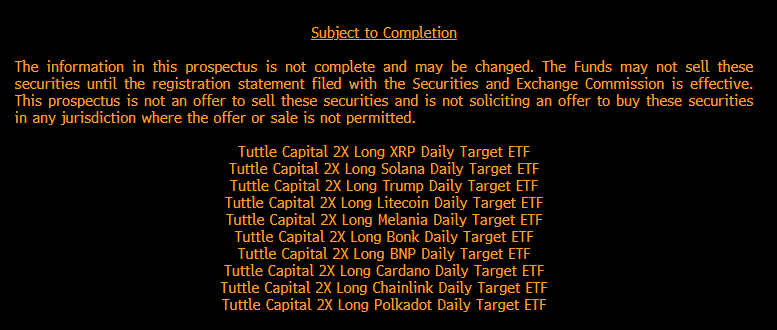

List of leverage ETFs.

1.Turtle Capital 2X Long XRP Daily

Target ETF

2.Turtle Capital 2X Long Solana Daily

Target ETF

3.Turtle Capital 2X Long Trump Daily

Target ETF

4.Turtle Capital 2X Long Litecoin Daily

Target ETF

5.Turtle Capital 2X Long Melania Daily

Target ETF

6.Turtle Capital 2X Long Bonk Daily

Target ETF

7.Turtle Capital 2X Long BNP Daily

Target ETF

8.Turtle Capital 2X Long Cardano Daily

Target ETF

9.Turtle Capital 2X Long Chainlink Daily

Target ETF

10.Turtle Capital 2X Long Polkadot

Daily Target ETF