2023-12-25

Celestia is a modular blockchain as opposed to traditional

monolithic blockchains. It is a proof-of-stake blockchain built from the Cosmos

SDK.

Celestia is a blockchain development tool that let developers launch

their own blockchains and rollups. Developers can use Celestia to build their

own blockchains or use Celestia to build rollups.

A blockchain transaction consists of 4 layers including

Execution layer

It imposes programming language that build on top of a

blockchain such as Ethereum Virtual Machine, Solana Virtual Machine, and Arbitrum VM.

Or it tells what blockchain development tool a particular

blockchain builds on such as OP Stack, Cosmos SDK, and Polygon CDK.

Consensus layer

It is a mechanism to create new blocks and confirm transactions

such as Proof-of-Work and Proof-of-Stake.

Data availability layer

Data availability means applications or validators post data on

blocks. It is data that available for downloading to verify the transactions

such as Alice transferred 5 BTC to Bob.

Settlement layer

It adds transaction data into the blockchain. Settlement layers

ensures the transaction cannot be rolled back when the transaction is

completed.

Building on Celestia, Developers that build rollups and blockchains work on execution

and settlement layers. And Celestia is responsible for consensus

and data availability layers.

1. TIA used for securing Celestia’s proof-of-stake

network.

Validators and delegators earn staking rewards from network fees.

2. TIA used for paying Celestia’s network transaction

fees.

TIA uses for paying transaction fees when data is published on

Celestia or use TIA to pay for data availability.

3. Layer 2 rollups that built using Celestia’s framework

use TIA to pay for their network’s transaction fees

The same way Arbitrum or Optimism use ETH to pay for their network’s

transaction fees.

4. Governance

TIA token holders can propose and vote on proposals to improve

Celestia’s network.

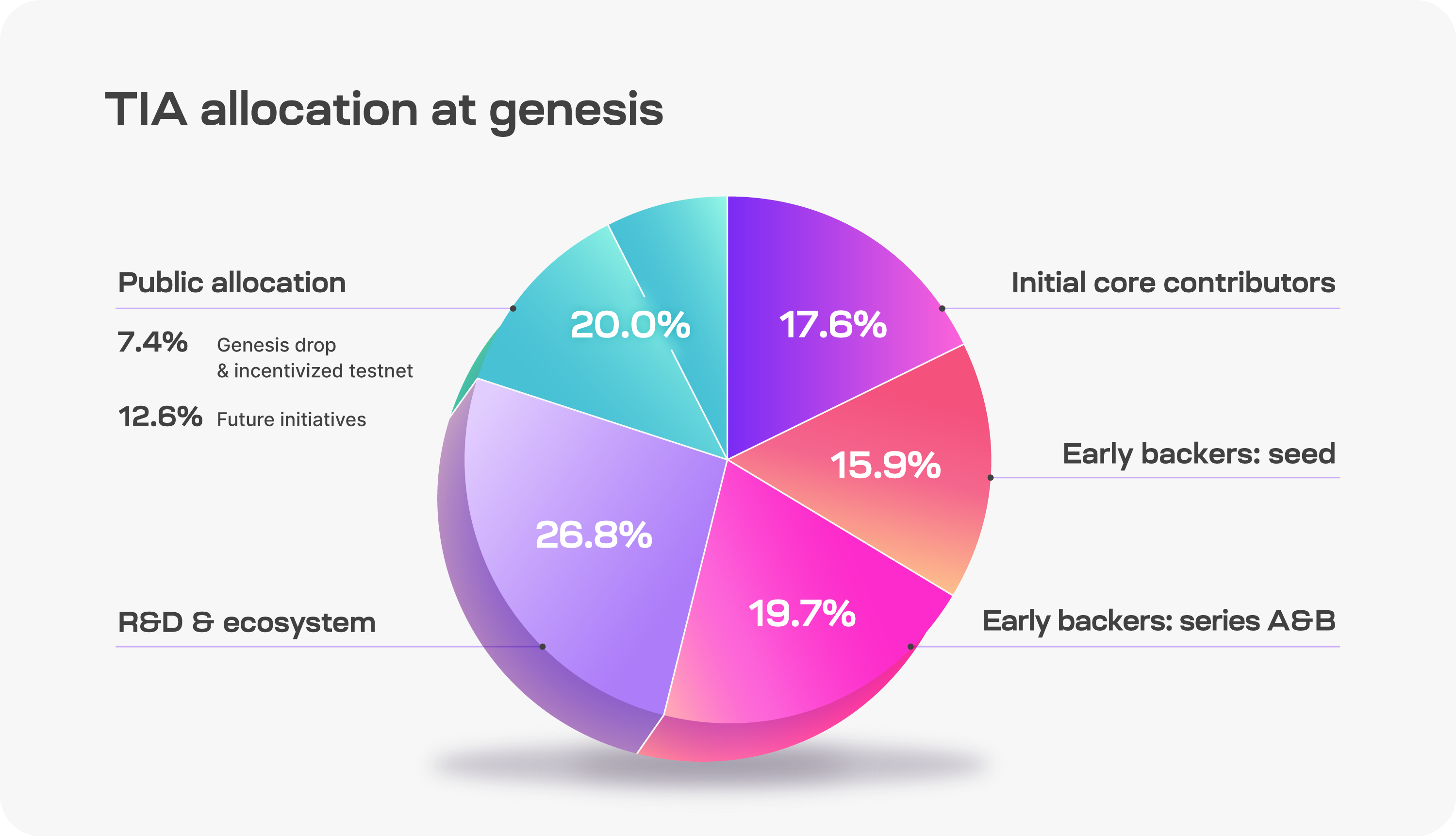

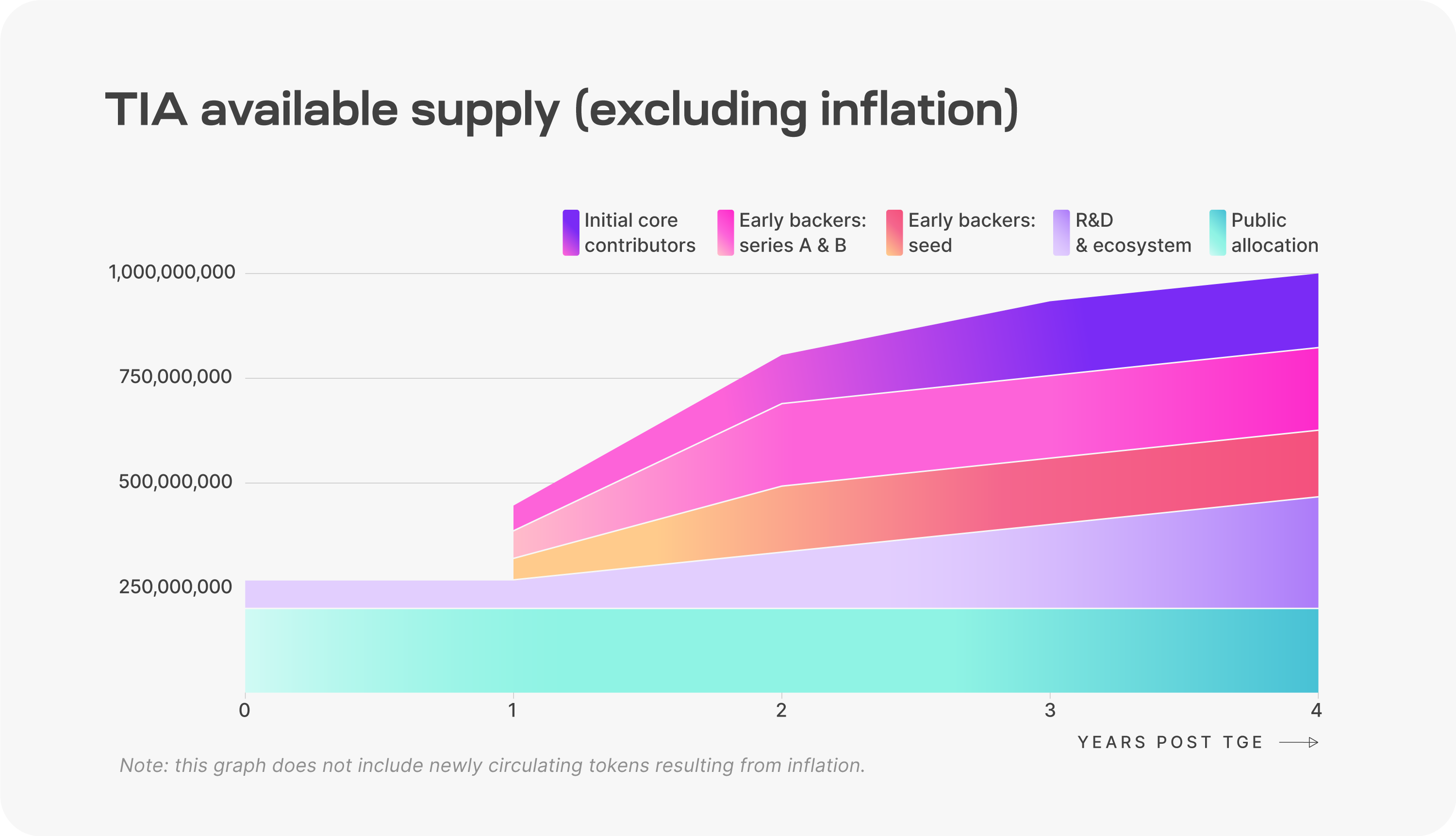

Total supply of TIA at genesis is 1 billion TIA.

|

Category |

Description |

% |

|

Public Allocation |

Genesis Drop and Incentivized Testnet: 7.4% |

20% |

|

R&D & Ecosystem |

Tokens allocated to the Celestia Foundation and

core devs for research, development, and ecosystem initiatives including: |

26.8% |

|

Early Backers: Series A&B |

Early supporters of Celestia |

19.7% |

|

Early Backers: Seed |

Early supporters of Celestia |

15.9% |

|

Initial Core Contributors |

Members of Celestia Labs, the first core

contributor to Celestia |

17.6% |

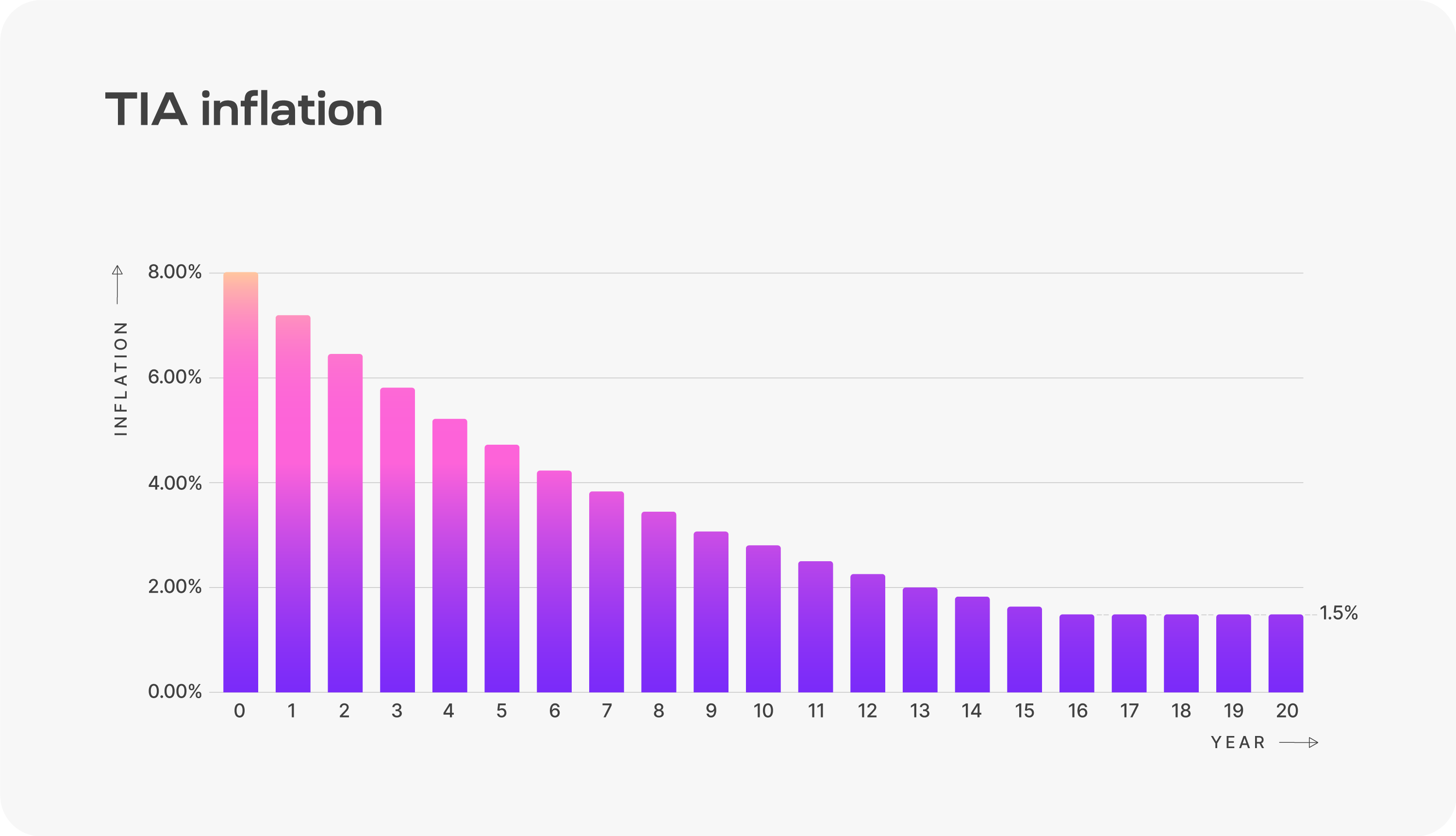

TIA long-term inflation is 1.5%

TIA inflation rate starts at 8%. It decreases 10% every year until

it reaches the final inflation of 1.5%.

TIA will hit 1.5% inflation in the 16th years in 2039.

Both Celestia’s block time and time to finality are 15 seconds. TIA transaction fees on Jan 8, 2023 is about 0.035718 TIA ($0.47).

List of blockchain development tools.

1. Celestia

2. Cosmos SDK

3. OP Stack

4. Polygon CDK

5. Polkadot’s Parachain

6. Avalanche Subnet

Celestia is a revolutionary idea to develop blockchains and there is

no doubt that Celestia is the future of blockchain.