2025-03-13

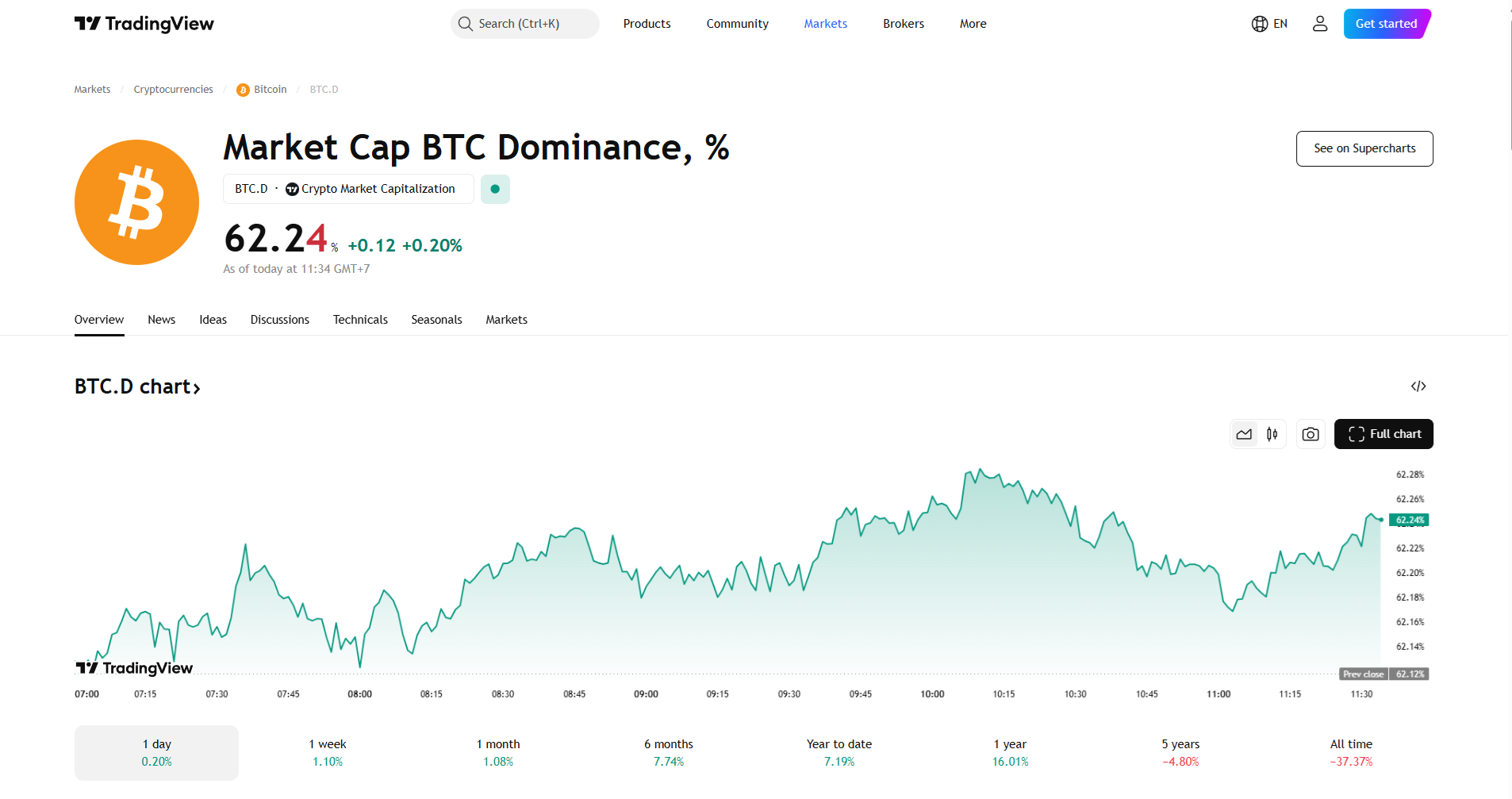

Bitcoin’s share of the cryptocurrency market has reached 62.24%, its

highest level in months, as altcoins lose momentum.

www.tradingview.com/symbols/BTC.D/

Bitcoin’s Market Strength

Despite falling from its peak price in December, Bitcoin is still

performing better than most other cryptocurrencies.

Its dominance was at 54% in December but has since climbed, showing

that the recent altcoin rally was short-lived.

Altcoins briefly gained ground after Donald Trump’s election win in

November. However, a strong U.S. jobs report in early December shifted focus to

the Federal Reserve, leading investors back to Bitcoin.

The Impact of Interest Rates

In January, the U.S. Federal Reserve decided to keep interest rates

unchanged instead of cutting them.

This decision, based on strong jobs data, negatively affected stocks

and cryptocurrencies.

Since the Fed’s announcement on January 29, Bitcoin’s price has

dropped about 20%, now trading around $83,335 (down from an all-time high of

over $109,000 in December).

Altcoins, which tend to react more to economic changes, have

suffered even more. Investors have shifted their money into Bitcoin, which,

despite its decline, has outperformed the broader crypto market.

What’s Next for Bitcoin?

One of the factors is Bitcoin’s rally depends on whether the Fed

raises interest rates to control inflation.

Recent inflation data suggests prices are cooling, with the Consumer

Price Index (CPI) dropping to 2.8% in February.

According to data from the CME Group, most investors expect the Fed

to keep rates unchanged at its next meeting in March.