2024-05-07

A day before FTX debtors were scheduled to release a new restructuring plan for the exchange, two wallets connected to the now-bankrupt FTX exchange and sister trading firm Alameda Research transferred a combined value of $8.3 million worth of cryptocurrency.

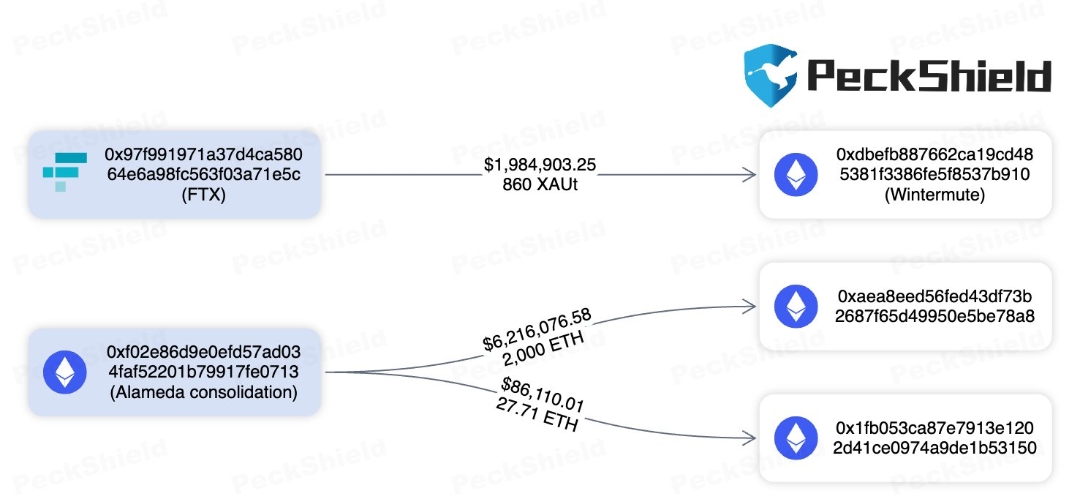

According to a May 6 post by PeckShield, the FTX-associated address transferred 860 Tether Gold (XAUT), equivalent to over $2 million, to algorithmic trading firm Wintermute.

Additionally, an Alameda-related wallet transferred a total of 2,027 Ether, worth over $6.3 million, to two unknown addresses.

Although the motive behind these transactions remains unknown, they coincide with the impending deadline for FTX debtors to submit an amended version of the "Plan and Disclosure Statement" on May 7.

This revised plan could provide FTX creditors with more clarity on how they will be compensated for their losses. The final deadline for objections is set for June 5.

The collapse of FTX and its numerous subsidiaries is considered one of the most significant unexpected events in the crypto industry, leading to users losing a minimum of $8.9 billion in funds.

This collapse marked the beginning of an extended period of decline in the cryptocurrency market, with Bitcoin hitting a low point of $16,000.

While the amended plan from FTX may offer customers some hope of recovery, certain creditors are anticipating negative developments.

Sunil, a prominent FTX creditor and member of the FTX Customer Ad-Hoc Committee, has advised users to reject the upcoming plan, as it is likely to favor the debtors.

In a post on May 5, Sunil expressed concerns about potential clauses that could absolve Sullivan & Cromwell (S&C) of any liability for their actions and secure a favorable position for John Ray, a representative of S&C. Sunil also highlighted the lack of recognition of property rights for creditors.

This warning follows a lawsuit filed by top FTX creditors against bankruptcy firm Sullivan & Cromwell, accusing them of actively participating in the multibillion-dollar fraud committed by the FTX Group.

The creditors claim that S&C financially benefited from FTX's fraudulent activities.

To date, FTX creditors have sold over $490 million worth of claims in 507 transactions through the crypto debt broker Claims Market.

However, the legal proceedings surrounding FTX's bankruptcy are expected to be lengthy, similar to the case of the Mt.

Gox cryptocurrency exchange, which experienced a notorious hacking incident in 2014. The users affected by the Mt. Gox hack are still awaiting compensation.