2025-02-21

The number of Litecoin transactions has

jumped by 243% in the last five months, as interest in a potential Litecoin

exchange-traded fund (ETF) grows.

Canary Capital took steps to prepare

for its own spot Litecoin ETF approval.

The 7 days price of Litecoin (LTC)

increased by 6.85%. Litecoin (LTC) currently ranks the 5th largest

crypto by market cap with the market cap of $10.2 billion.

Litecoin’s daily transaction volume has

reached $9.6 billion, compared to $2.8 billion in August.

This increase has pushed Litecoin’s market

value up by 46% from February 2 to February 19, according to data from

Santiment.

Since early November, LTC prices have doubled,

outpacing the general crypto market, which gained 42% in the same period.

The U.S. Securities and Exchange

Commission (SEC) acknowledged a proposed rule change on February 19 to allow CoinShares'

spot Litecoin ETF to be listed on Nasdaq.

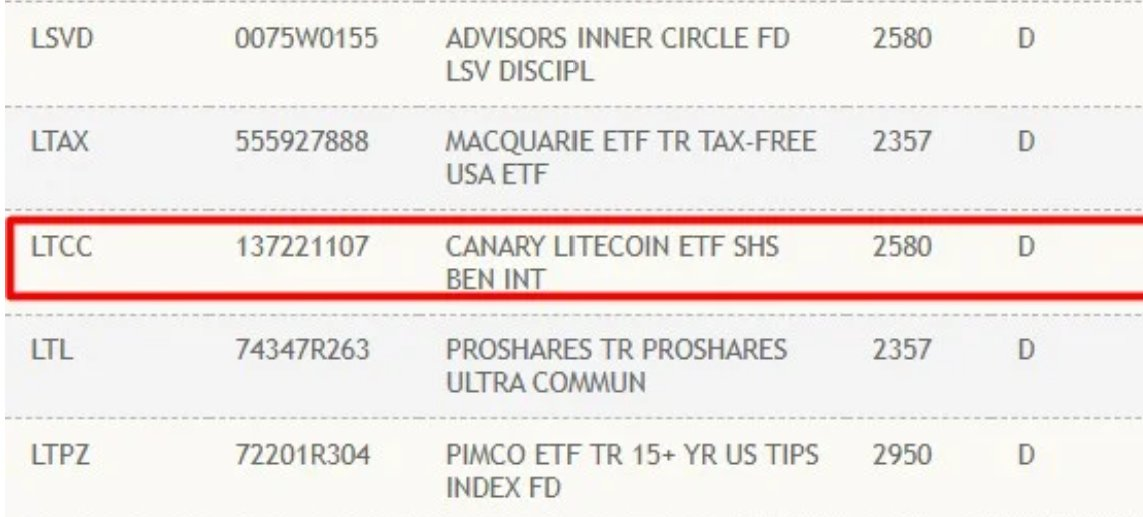

On February 20, Canary Capital’s Litecoin ETF appeared in the Depository Trust and Clearing Corporation (DTCC) system under the ticker LTCC.

The DTCC plays a crucial role in

financial markets, handling trillions of dollars in transactions daily. The

Litecoin Foundation explained that appearing on the DTCC system is an important

step toward launching the fund.

Bloomberg ETF analyst Eric Balchunas

warned that appearing on DTCC does not mean the ETF is approved yet, but it shows

preparation. He still estimates a 90% chance of approval this year.

After the DTCC listing, Litecoin's

price jumped 8.5%, from $127 to $138, before a slight decline on February 21.

Over the past two weeks, Litecoin has

risen almost 30%, performing better than Bitcoin, which has remained stable in

price.

Investors are excited about the

possibility of a Litecoin ETF, following the approval of Bitcoin ETFs last

year. If approved, this could further boost Litecoin’s price and adoption in

the crypto market.