2025-01-08

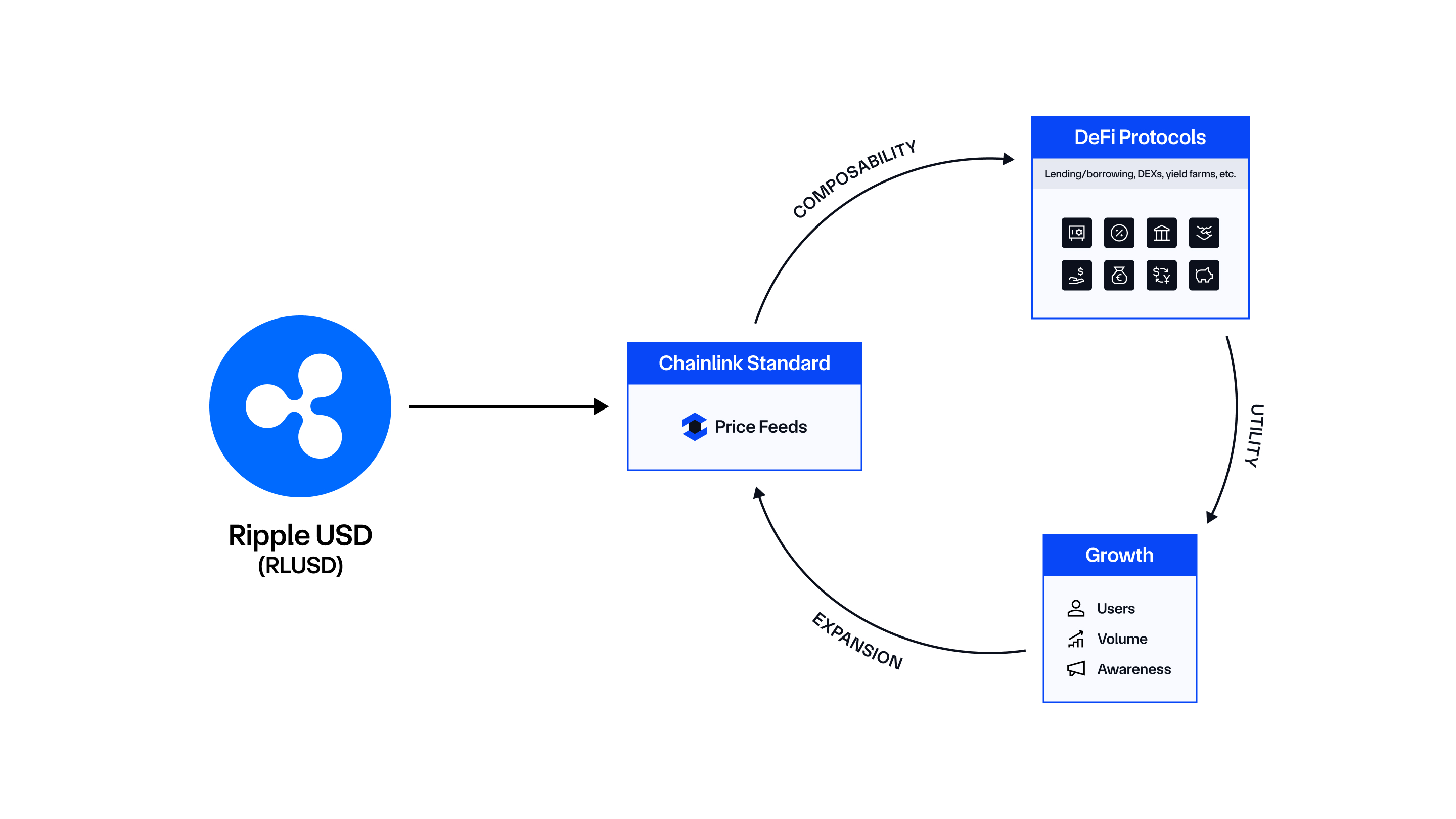

Ripple has partnered with Chainlink to

enhance the utility and adoption of its Ripple USD (RLUSD) stablecoin in

decentralized finance (DeFi) markets.

This collaboration, announced on

January 7, 2025, will provide RLUSD with tamper-proof and accurate price feeds

on Ethereum and the XRP Ledger.

The adoption of the Chainlink standard will

enhance the utility and accessibility of its Ripple USD (RLUSD) stablecoin

within the decentralized finance (DeFi) ecosystem.

By leveraging Chainlink’s reliable

pricing data infrastructure, Ripple aims to drive greater adoption of RLUSD as

a trusted, USD-denominated stablecoin backed by Ripple’s extensive experience

in blockchain and traditional finance.

Chainlink Price Feeds Now Live for

RLUSD on Ethereum

The integration of Chainlink Price

Feeds on the Ethereum mainnet allows developers to access accurate and secure

RLUSD pricing data. This enables the incorporation of RLUSD into DeFi

applications for use cases such as trading, lending, and other financial

services.

By adopting Chainlink’s infrastructure,

Ripple provides the RLUSD ecosystem with high-quality offchain data delivered

onchain, utilizing a decentralized oracle network that has facilitated over $18

trillion in transaction value globally. Chainlink’s reputation for reliability

and scalability makes it a natural choice for this collaboration.

Stablecoins: Revolutionizing Financial

Transactions

Stablecoins like RLUSD offer a

transformative opportunity to streamline financial transactions with low-cost,

instant settlement for local and cross-border payments.

Ripple launched RLUSD with a 1:1 peg to

the US dollar, issuing it on the XRP Ledger (XRPL) and Ethereum blockchain.

This design ensures native compatibility with DeFi smart contract applications.

To support RLUSD adoption in DeFi,

Ripple identified the need for high-quality, decentralized pricing data.

Chainlink’s infrastructure delivers a unified solution to address these

challenges and accelerate RLUSD’s integration within DeFi.

Secure and Reliable Onchain Markets

DeFi applications require robust,

tamper-proof data to manage risks effectively. Chainlink Price Feeds provide:

This trusted pricing infrastructure

ensures fair market valuations and reinforces RLUSD’s position in decentralized

markets.

Strategic Insights from Ripple and

Chainlink

Johann Eid, Chief Business Officer at

Chainlink Labs, expressed enthusiasm about the collaboration:

“The adoption of tokenized assets like stablecoins is accelerating, and

access to reliable onchain data will play a critical role. We’re thrilled to

work with Ripple to advance RLUSD adoption through Chainlink’s infrastructure.”

Jack McDonald, SVP of Stablecoin at

Ripple, highlighted the importance of pricing transparency:

“Reliable data is essential for RLUSD’s success in decentralized markets.

Chainlink’s trusted infrastructure strengthens RLUSD’s utility across

institutional and DeFi applications.”

With this strategic partnership, Ripple

and Chainlink are paving the way for broader adoption of stablecoins in DeFi,

furthering innovation in blockchain-based financial ecosystems.

The integration aims to support

cost-effective transactions and various DeFi use cases, such as trading and

lending.

By leveraging Chainlink's decentralized

oracle network, RLUSD will benefit from real-time, high-quality market data,

reducing risks of manipulation or downtime.