2025-01-30

Jan 29, 2025 - the U.S. Securities and Exchange

Commission (SEC) has taken a step toward evaluating the Canary Litecoin ETF,

inviting public comments on the proposal as part of its review process.

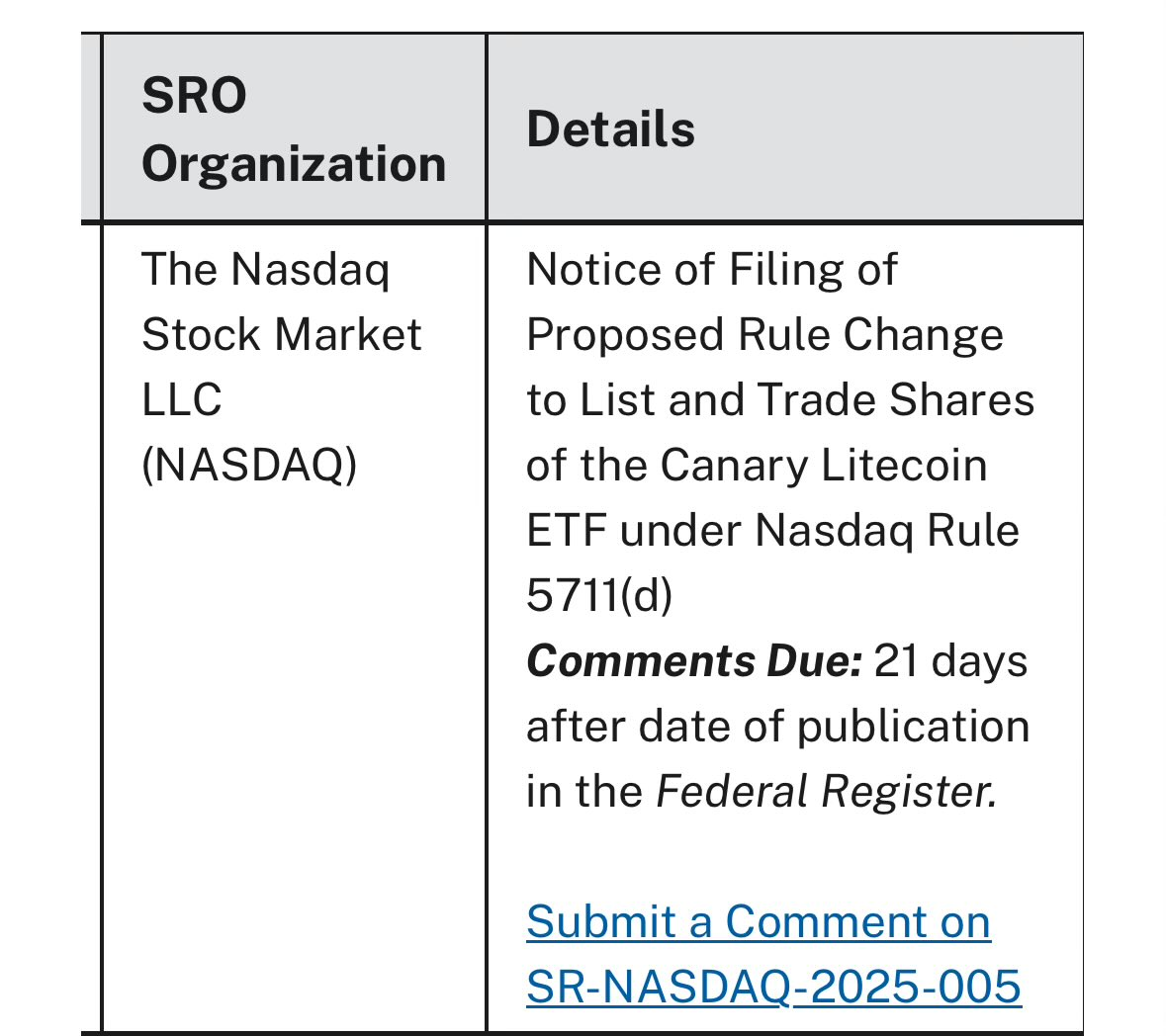

The request for feedback follows a

19b-4 filing submitted by Nasdaq on January 16, marking a critical moment in

the approval process for a spot Litecoin exchange-traded fund (ETF).

According to a filing released on

Wednesday, the SEC has opened a 21-day comment period following the publication

of the proposal in the Federal Register.

It signals progress in the agency’s

deliberations over whether to approve or reject the ETF.

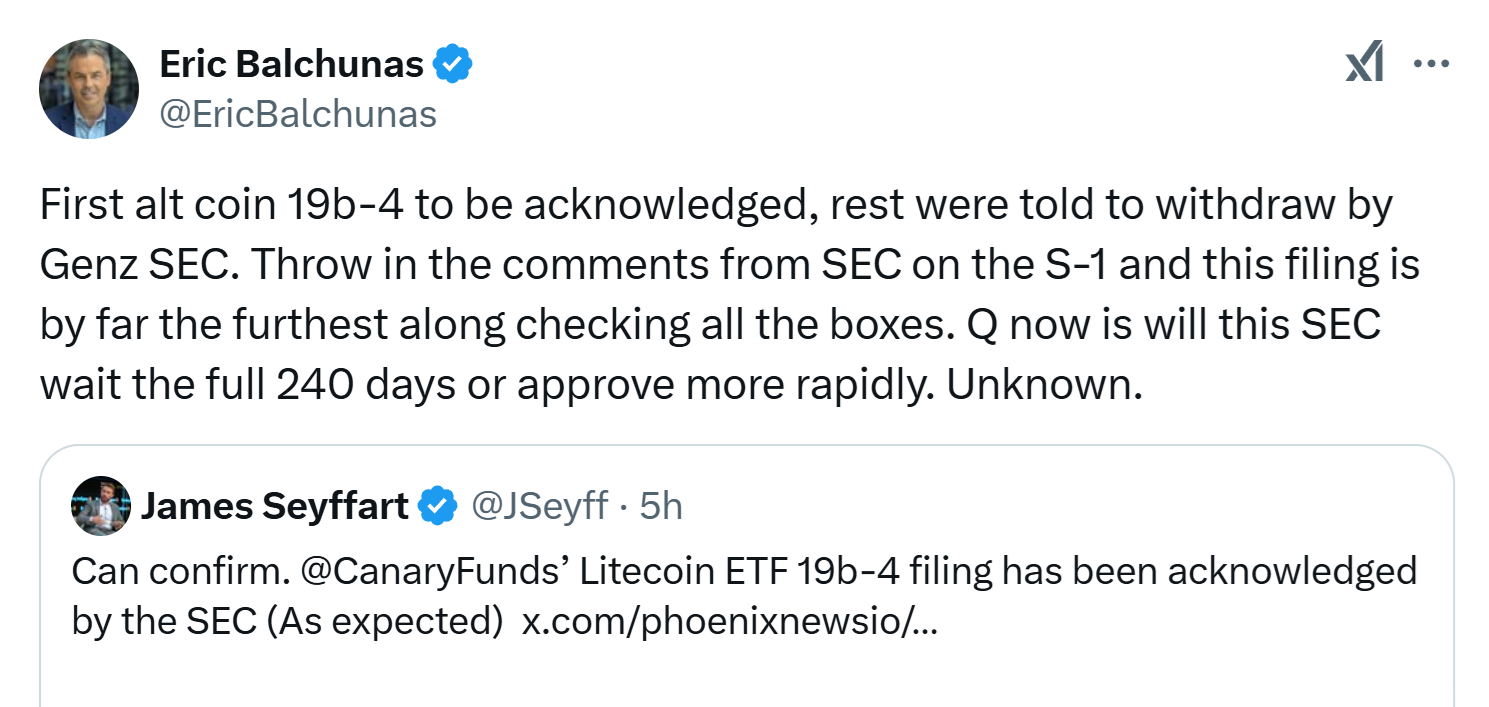

Eric Balchunas, a senior ETF analyst at

Bloomberg, noted that Nasdaq’s 19b-4 filing for the Canary Litecoin ETF was the

first altcoin ETF to receive an official acknowledgment from the SEC.

The 19b-4 filing represents the second

phase of a two-step process in launching a spot crypto ETF, requiring SEC

review and potential approval before an ETF can be listed for trading.

The move comes amid growing interest in

cryptocurrency-based ETFs. Several firms are currently vying to launch crypto

ETFs tied to alternative digital assets, including Solana and XRP.

There have even been proposals for

leveraged ETFs linked to meme-based cryptocurrencies associated with former

President Donald Trump and First Lady Melania Trump, reflecting speculation

around a potentially crypto-friendly administration.

The SEC's stance on cryptocurrency ETFs

has evolved in recent years.

In January 2024, the agency approved

the first U.S. spot Bitcoin ETFs, followed by Ethereum ETFs later that year.

The regulatory body is currently led by

Acting Chair Mark Uyeda, who recently appointed Commissioner Hester Peirce to

lead a crypto-focused task force.

Their leadership marks a departure from

former Chair Gary Gensler’s more cautious approach to crypto regulation. Former

US SEC Chair Gary Gensler appointed professor at MIT Sloan after the left the

SEC.

As the public comment period begins,

all eyes remain on the SEC’s next move, whether it will expedite the approval

process or take the full 240-day review period before reaching a decision.