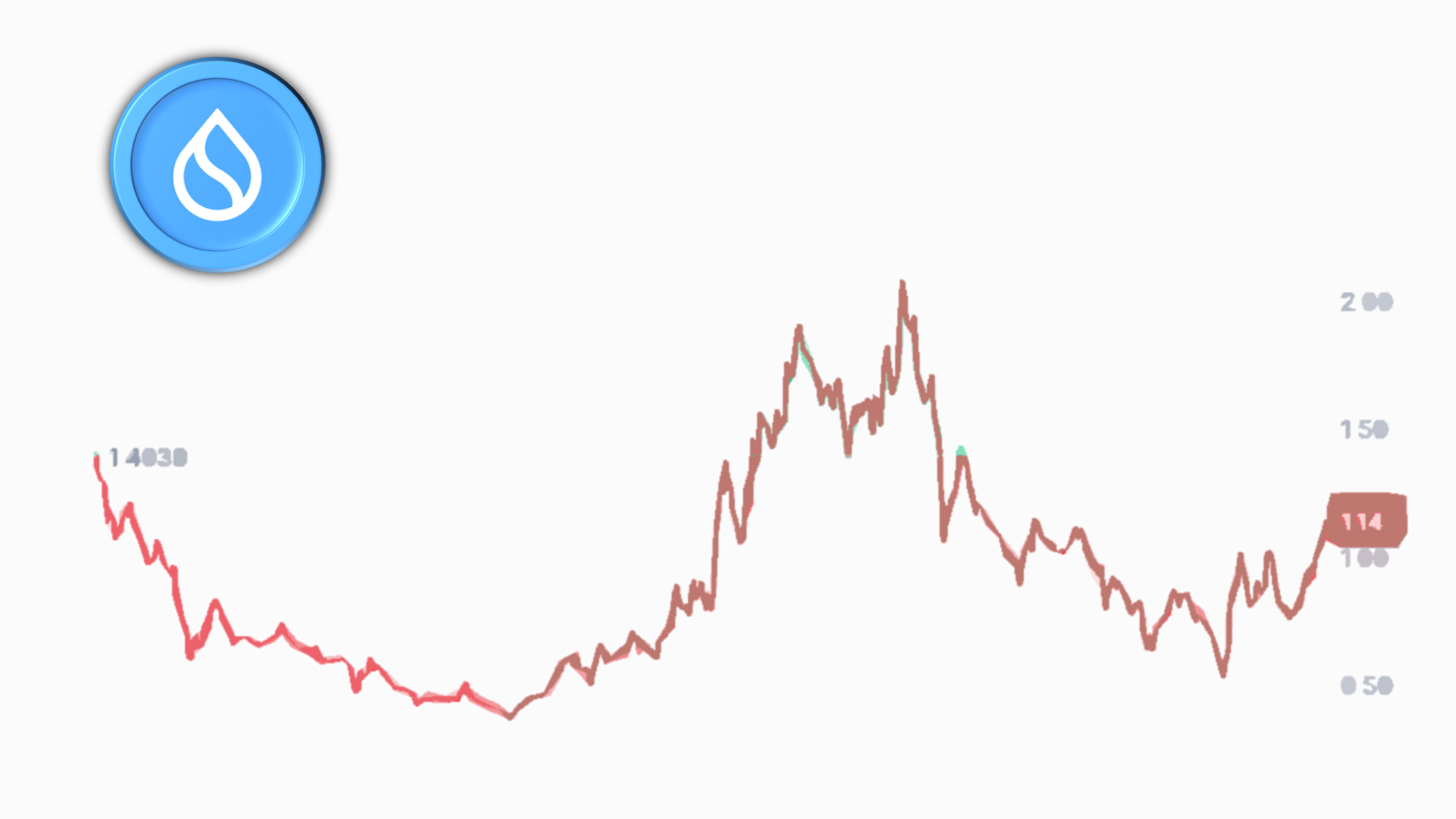

2024-09-17

A support level is a price point at which an asset like SUI

finds buying interest strong enough to prevent the price from

falling further.

Sui has a support level of $0.53 per

SUI. Since then, the price of SUI has rebounded, it currently trading at $1.14

per SUI.

SUI token had breakout from resistance

level of $1.01. A breakout occurs when the price moves beyond

a resistance level, often accompanied by increased volume.

Breakouts signal that the asset is

likely to continue moving in an upward direction. Look from chart pattern SUI price is showing bullish and likely uptrend chart

pattern.

What is SUI

Sui is a decentralized layer-1

blockchain and a smart contract platform developed by Mysten Labs,

a company founded by former executives and engineers from Meta’s (formerly

Facebook) Diem blockchain project and Move programming

language team.

Launched in 2023, Sui aims to provide a

highly scalable, low-latency blockchain infrastructure with a focus on

supporting the next generation of decentralized applications (dApps) and Web3

projects, including gaming, finance, and other high-performance use cases.

Key Features of Sui:

Move Programming Language: Sui is built using the Move programming

language, originally developed for the Diem blockchain. Move is designed to be

more secure and flexible than traditional smart contract languages like

Solidity, reducing the likelihood of vulnerabilities. Move was influenced by

Rust programming language.

Parallel Transaction Processing: Unlike most blockchains that process

transactions sequentially, Sui uses a parallel processing model.

This allows for high throughput (processing many transactions simultaneously),

which is essential for large-scale dApps, particularly in gaming and financial

services.

Scalability: Sui can achieve high scalability by processing simple,

independent transactions (like payments) in parallel without the need for

consensus among all nodes. For complex transactions, Sui employs a consensus

mechanism based on Narwhal and Tusk, a DAG-based (Directed Acyclic

Graph) protocol that helps with efficient consensus.

Sui is a high-performance blockchain designed to provide instant

settlement (480 milliseconds time to finality) and high

throughput (120,000 transactions per second).

Storage Model: Sui uses a unique object-centric data model,

where smart contracts operate on programmable objects. This allows the chain to

easily track and manage the ownership and transfer of assets, offering enhanced

security and programmability for complex applications like NFTs, assets in

games, or DeFi.

Gas Fees and Cost Efficiency: Sui employs a fee structure that aims to

remain low and predictable even as transaction volumes increase. By leveraging

its unique architecture and parallel execution, Sui keeps gas fees low without

sacrificing performance.

Developer-Friendly: Sui aims to make it easier for developers to build

scalable dApps with improved tools, better error handling, and advanced testing

capabilities provided by the Move language and development ecosystem.

SUI token utility

1. Gas Fees:

2. Staking and Validator Rewards:

The maximum supply of SUI

tokens is 10 billion. This supply is fixed and will not

increase beyond this cap.

Sui currently has $711 million in total

value locked (TVL). The current marketcap ranking of Sui is 27th ,

it has a market cap of $3.0 billion.

Sui has been considered part of the

“next-generation” of blockchains alongside competitors like Aptos,

which also emerged from the Meta/Diem project. The Sui blockchain is

particularly well-suited for Web3 gaming and DeFi,

where low-latency and high throughput are essential for user experience.