2024-06-01

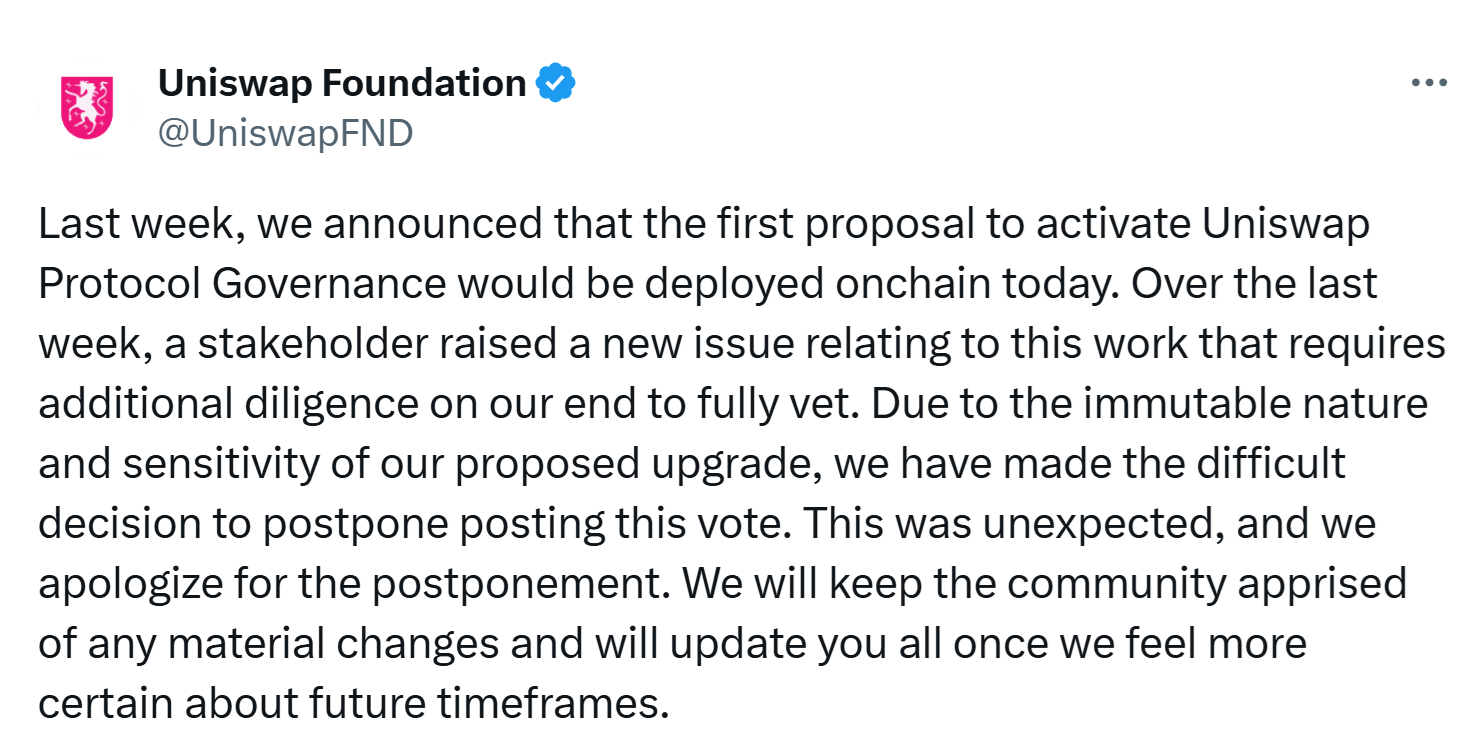

Uniswap Foundation has postponed the

vote on a proposal that would introduce staking and delegation rewards for UNI

token holders that earlier scheduled for May 31, 2024.

Uniswap Foundation does not specify the

exact date for the vote yet.

This delay was due to an issue raised

by a stakeholder, which required additional scrutiny. The proposal is

significant as it would activate the decentralized exchange’s “fee switch,”

providing incentives to those who stake and delegate their UNI tokens.

UNI token holders who

have staked and delegated their tokens are eligible for rewards. Staking

involves locking up your tokens in a smart contract, while delegating means

assigning your voting rights to another address.

The collected fees will

be distributed to UNI token holders who have staked and delegated their votes.

This means that the more tokens you have staked and delegated, the larger your

share of the rewards.

Uniswap makes between $1

million and $5 million in daily trading fee. If approved, this proposal could

pay out between $62 million and $156 million to UNI holders in annual

dividends.

The postponement led to a notable

decrease in the value of Uniswap’s UNI token, which fell more than 7% to $10.03.

The decision has been met with

criticism from some community members, including Dan Robinson from Paradigm,

who expressed disappointment over the influence of a large venture-capital firm

on the governance process.

The Uniswap community has been

discussing the activation of a fee switch for years, with several previous

proposals not moving forward, mostly due to concerns over US securities laws

violations. The current proposal, designed by the Uniswap Foundation, aimed to

address these concerns and had received support during an earlier advisory vote.